- How to Initiate the Insurance Claim Process in UAE?

- Documents Required for the Insurance Claim Process in UAE

- How to Get the Police Report in Dubai, Sharjah, Abu Dhabi & Other Emirates

- Roadside Assistance Number of All UAE's Top Insurers

- Policybazaar UAE Helpline for Your Convenience

- What to Do in Case of Rejected Claims?

Make Claim Approval Easy -

- If your car is completely or partially submerged underwater, don’t try to start it. Instead, follow the insurance claim registration process and connect with a roadside assistance company. Next, get your car towed to the garage allocated to you by your insurance provider.

- Avoid driving your vehicle in flooded regions.

- You cannot file a motor claim regarding flood damage if you have a third-party liability (TPL) insurance policy.

Only if you have a comprehensive insurance policy, you should initiate the insurance claim process. The insurance provider will take the process further.

With that clear, here’s a guide on the motor claim registration process amidst this dire scenario.

How to Initiate the Insurance Claim Process in UAE?

To start the car insurance claim process, make a claim intimation. Here are the steps for the same —

- Report the incident to the police and get a police report by following the due process for the concerned Emirate.

- If you need towing services, connect with your insurance provider’s round-the-clock free roadside assistance helpline.

- Record the damages via videos and photographs as proof of investigating the damages accurately.

You can visit https://www.policybazaar.ae/claim/, select your insurance provider, and follow the described process.

For your convenience, let’s understand what needs to be done once you file a claim intimation as well —

- If roadside assistance is covered under the plan, the insurer will arrange pickup upon claim filing.

- The repairer will create a detailed repair estimate and send it to the insurer for review.

- A qualified insurance surveyor will approve the repair work post-inspection.

- You'll get repair duration confirmation and be notified upon completion. You can then collect the car from the repairer.

- Once you receive the car, you will get a survey questionnaire via email. Fill in the survey.

Note — If the damage to your car was due to your fault, you will need to settle the repair costs before collecting your vehicle.

Documents Required for the Insurance Claim Process in UAE

Here's a list of documents required for the car insurance claim process —

- Vehicle registration card copy (both sides)

- Copy of the owner’s driving licence and the driving licence of the person driving the vehicle at the time of claim

- Emirates ID card copy of the driver and that of the person driving the vehicle at the time of claim (if applicable)

- Copy of the police report

Important: Here are the steps to get a police report for different Emirates —

How to Get the Police Report in Dubai, Sharjah, Abu Dhabi & Other Emirates

Getting Police Report in Dubai

- Step1- Go to the Dubai Police Services page on www.dubaipolice.gov.ae.

- Step2-Click on the ‘To Whom It May Concern’ (TWIMC) certificate and access the service.

- Step3-Put your Emirates ID in the specified field.

- Step4-Click on the type of certificate you want.

- Step5-Add your location, occurrence date, and vehicle details.

- Step6-If required, upload the pictures of the vehicle.

- Step7-Click on the next button and provide your details.

- Step8-Pay the service fee.

- Step9-Once done, you will receive a transaction number via email or SMS and get the certificate shortly.

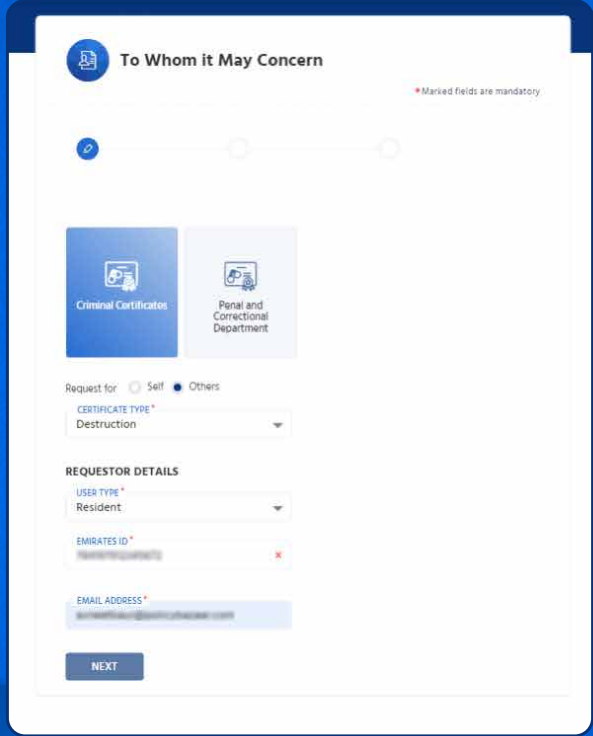

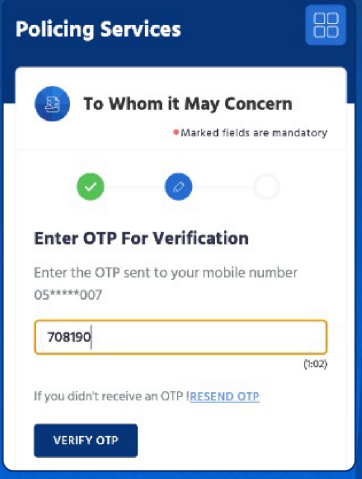

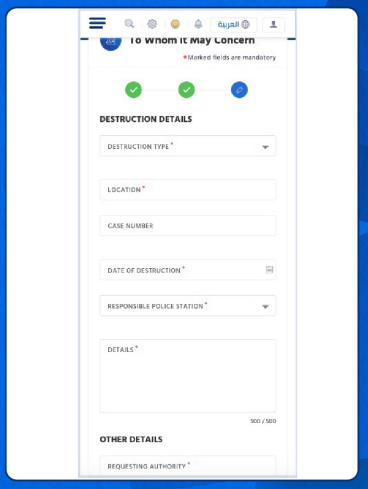

Getting Police Report in Sharjah

- Step1- Go to www.shjpolice.gov.ae.

- Step2- Select the ‘Criminal Type Certificates’ before choosing ‘Destruction’. & Enter the applicant details.

- Step3- Verify the code sent to your registered mobile number.

- Step4- Provide destruction details related to the type, date, and location, and request authority and relevant images of the damage.

- Step5- Once done, you will receive a request number for your query.

Getting Police Reports in Al Ain, Fujairah, Abu Dhabi, Ras Al Khaimah, and Umm Al Quwain

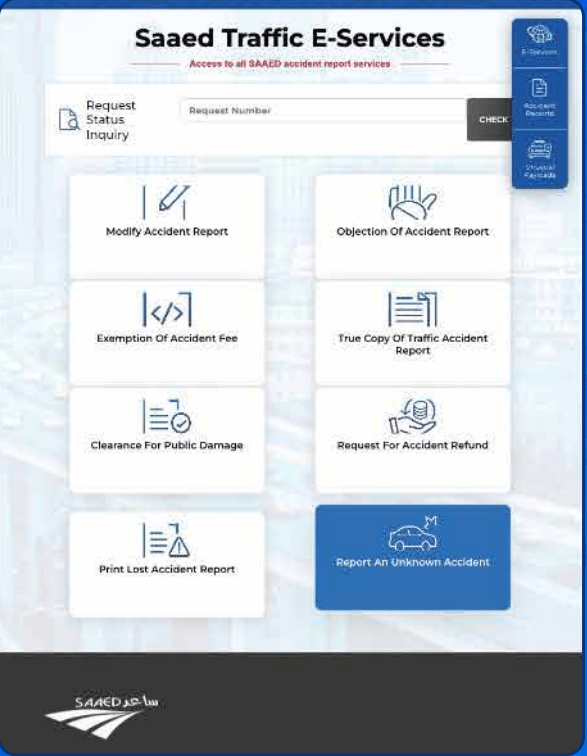

- Step1- Visit www.saaed360saared.ae.

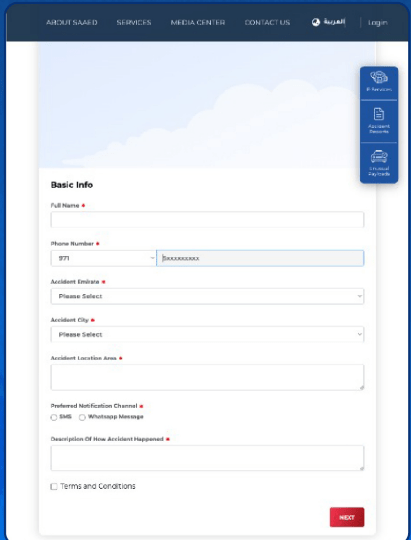

- Step2- Choose the Report an Unknown Accident option.

- Step3- Fill in the applicant details.

- Step4- Follow the steps as instructed thereon and get a police report.

Roadside Assistance Number of All UAE's Top Insurers

Having understood the car insurance claim process, here are some important roadside assistance numbers —

| Insurance Providers | Roadside Numbers |

|---|---|

| Adamjee Insurance | 8007326 |

| Al Sagr Insurance | 8003541 |

| Al Wathba Insurance | 600575751 |

| Arabia Insurance | 8000914001 |

| Emirates Insurance | 80073 |

| GIG | 800292 |

| Ittihad Al Watani | 600575751 |

| New India Insurance | 800247772 |

| Orient Takaful | 600508181 |

| Qatar Insurance | 600508181 |

| Salama Insurance | 600575751 |

| Sukoon Takaful | 8007326 |

| Union Insurance | 600575751 |

| Al Buhaira Insurance | 8000914001 |

| Alliance Insurance | 600508181 |

| Dubai National Insurance | 600575751 |

| Fidelity United | 600575751 |

| Insurance House | 600575751 |

| Methaq | 600575751 |

| Orient Insurance | 600575751 |

| Oriental Insurance | 600575751 |

| RAK Insurance | 600575751 |

| Sukoon Insurance | 8006565 |

| Tokio Marine | 600508181 |

| Watania Takaful | 600575751 |

Policybazaar UAE Helpline for Your Convenience

- Contact Number — 800 800 001 (Toll free number)

- Timings — 8 am to 8 pm (all days of the week)

- Email Address — care@policybazaar.ae

When you connect with us, make sure to keep the following documents handy —

- Policy number

- Registered email address

- Registered phone number

- Relevant documents

Here are the Emergency Helpline Numbers for a Crisis

- Electricity Failure — 991

- Coastguard — 996

- Ambulance — 998

- Water Failure — 922

- Find and Rescue — 995

- Fire Department — 997

- Police — 999

What to Do in Case of Rejected Claims?

The Central Bank has urged the public to carefully review insurance policies to ensure proper exercise of their rights. SANADAK is available to resolve banking and insurance disputes.

Check SANADAK's guidelines on complaint acceptance and potential rejections here — https://www.sanadak.gov.ae/make-a-complaint/complaint-eligibility/

For the complaint registration process, visit https://sanadak.gov.ae/en/make-a-complaint/complaint-submission-process/

Related Links -

| How to File Your Car Insurance Claim in the UAE |

| How to Claim Insurance for Car Accident in Dubai |

| How Long Does a Car Insurance Claim Take? |

| How to Get No Claim Certificate from Insurance Company |

More From Car Insurance

- Recent Articles

- Popular Articles

.jpg)

-in-car-insurance.jpg)