RAKBANK Car Loan Calculator

Calculate Your Car Loan EMI Online

RAKBANK offers a user-friendly car loan calculator to assist you in planning your car purchase and loan repayment. With the RAKBANK EMI calculator, you can estimate your monthly repayments using details such as loan amount, interest rate, and loan tenure.

As an applicant, the RAKBANK car loan calculator can be pretty beneficial for you. Instead of taking shots in the dark, you can simplify the whole process and make an informed decision about your car financing options.

What are the Features of the RAKBANK Car Loan?

Before moving on to the calculator, let’s check out the key features and benefits of a RAKBANK car loan in the UAE -

- Competitive interest rates starting from 2.89% (flat) per annum

- Low-cost loan without any hidden charges

- Salary transfer not mandatory

- Enjoy up to 2 deferrals once every year

What are the Benefits of the RAKBANK Car Loan Calculator?

With a RAKBANK EMI calculator, you can enjoy a wide range of benefits -

- Wise Financial Planning - With the RAKBANK car loan calculator, you can find a suitable loan option by pre-assessing the EMI amount. This way, you can find out the right amount where you can maintain a balance between your regular expenses and loan EMI expenses.

- Time Management - RAKBANK auto loan calculator is automated and produces results within a few seconds. This way, you don’t need to do any complex calculations by yourself.

- Accuracy - With human calculations, the chances of errors can increase. However, with this online calculator, you can get accurate results in a second or two.

- Real-time Comparison of Options - With the help of the RAKBANK car loan EMI calculator, you can compare the instalments of loans from multiple banks and other lending institutions. This can help you find the best fit for your financial needs.

How to Calculate RAKBANK Car Loan Monthly Instalments?

You can easily access the RAKBANK car loan calculator via its official website. The tool is free for everyone.

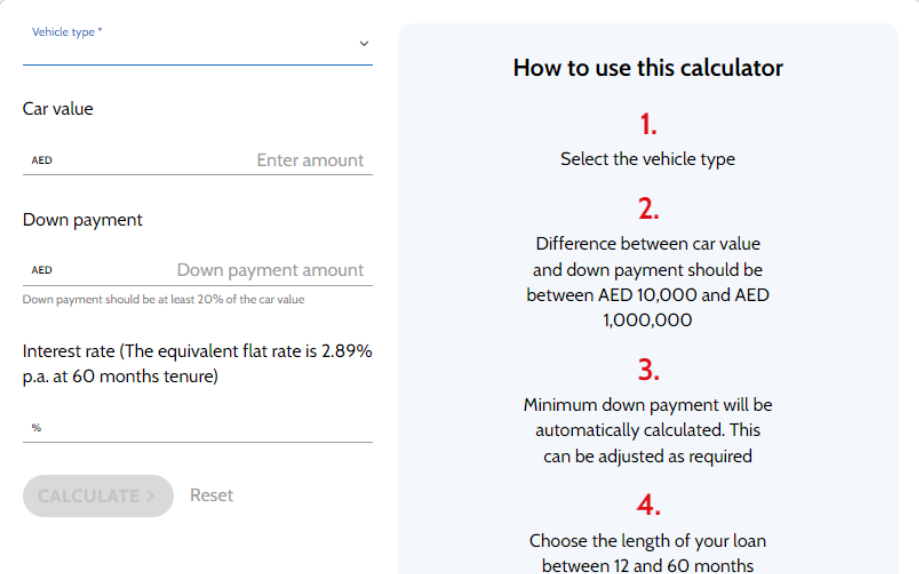

Image Source: RAKBANK Car Loan

You can also use the online calculator on Policybazaar.ae. Here are some easy steps to use it -

- On policybazaar.ae, click on the ‘Banking Products’ drop-down.

- Select ‘Car Loan Calculator’.

- On the next page, locate the calculator.

- Enter your car price, interest rate, loan tenure, and down payment.

- The result will be instantly displayed.

You May Also Check

| Emirates NBD Personal Loan | Emirates NBD Home Loan |

Frequently Asked Questions

Ans: Estimating your monthly payment amount for the RAKBANK car loan can help you manage your finances beforehand and create a proper schedule to incorporate the new expenses into your monthly budget.

Ans: Yes, the early settlement of your RAKBANK car loan in UAE is possible. However, a small early settlement fee will be applicable.

Ans: You will need your estimated loan tenure, loan amount, and the estimated profit rate to calculate the equal monthly payment of your RAKBANK account.

Ans: Yes, your loan repayment tenure will impact the equal monthly payment amount. A longer loan repayment tenure leads to smaller monthly payment amounts, while a smaller one leads to larger monthly payment amounts.

Ans: The promo period refers to the allowed grace period for payment of the first instalment of your car loan. RAKBANK allows up to 180 days of promo period.

Ans: You can choose between monthly, quarterly, half-yearly, and annual payment frequency options when using this car loan EMI calculator.

More From Car Loans

- Recent Articles

- Popular Articles