- What Does a 500 Credit Score Mean?

- What is the Impact of 500 Credit Score?

- Credit Cards for 500 Credit Score

- Personal Loans for 500 Credit Score

- 500 Credit Score Home Loans

- Auto Loans for 500 Credit Score

- 500 Credit Score and Insurance Plan

- Getting Loans for 500 credit score – Things to Try

- Building Credit – What Can You Do to Improve your 500 Credit Score?

- Key Takeaways

500 Credit Score: Good or Bad?

Credit score UAE is a number that helps banks and other financial institutions determine if you can be trusted to repay the borrowed money (and on time). These scores are quite important — they affect your chances of getting credit cards or loans as well as the applicable interest rates.

This piece is dedicated to understanding your financial standing as someone with a 500 credit score in UAE. We will also understand whether a 500 credit score is good or bad, what are the loan or credit card options with such a score, and more.

Let’s start from the basics.

What Does a 500 Credit Score Mean?

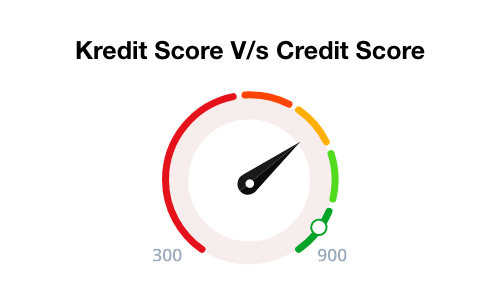

Credit score, ranging from 300 to 900, show your creditworthiness. A good credit score signifies that you can be relied upon regarding the repayment of the borrowed money. On the other hand, a low credit score indicates that you are unable to manage borrowed money as well as utility bill payments and more.

Credit scores in UAE can be divided into 5 basic categories — very low, low, moderate, high, and very high. Each category carries a star rating ranging from 1 to 5 stars, with very low being the 1-star category and very high being the 5-star category.

Credit scores above 746 points are considered very high and denoted by a 5-star rating. The range of 711-745 is the range for high credit scores with 4-star ratings. Meanwhile, credit scores between 651 and 710 are generally considered medium or moderate credit scores with a 3-star rating. The fourth category ranges between 541 and 650 and is marked by 2-star ratings. Finally, credit scores ranging between 300 and 540 are considered very low with only a 1-star rating.

As per the categorisation, a 500 credit score in UAE is considered a very low credit score. This shows that your perceived credibility is low and that you will be considered a high-risk borrower by lenders.

What is the Impact of 500 Credit Score?

A ‘very low’ credit score can pose difficulties when you want any credit instrument — credit cards as well as loans. Such a poor AECB credit score also impacts the interest rate of your credit product — the lower your score, the higher your interest.

All in all, a 500 credit score in UAE hurts your chances of getting any credit product.

Credit Cards for 500 Credit Score

Getting credit cards for 500 credit score may prove challenging in the UAE. The Emirates are rather strict about their policies, whether it is the banking sector or the federal government services. As a 500 credit score is considered very low, and a very low credit score makes it hard to get a credit card one desires, you may be required to make significantly more efforts to obtain the same.

Having said that, several banks offer select credit cards even to customers with a very low credit score even if applying additional precautions to protect the interest of the banks. Given below are some types of available credit cards for 500 credit scores in the UAE:

- Secured Credit Cards: A certain amount of money is required to be deposited with the bank before you can obtain a secured credit card. This fund is treated as a security deposit – to be used if the credit cardholder defaults on payments. The deposited funds are returned to the customer when they close the credit card account after full settlement. Secured credit cards are some of the top choices among customers for credit cards for 500 credit score.

- Unsecured Credit Cards: Finding an unsecured credit card that suits your requirements even with a 500 credit score may be highly burdensome. Unsecured credit cards are generally allotted to customers with high credibility only. And while a lender or bank may offer you an unsecured credit card for 500 credit score, there is a conundrum involved: you will most likely get a very high interest rate for unsecured credit cards for a 500 credit score.

- Special Benefit Credit Cards: Credit cards like cash back credit cards, reward points credit cards, travel credit cards, and others are known as special benefit credit cards. Most credit cards for 500 credit score available in the UAE come with one or more special benefits entwined. Have a word with your bank to find out the available options.

Personal Loans for 500 Credit Score

The key attractions of personal loans are the flexibility to use them for any purpose and the possibility of negotiating low interest rates for the applicants. Unlike other types of loans, personal loan interest rates can be negotiated with the bank provided the applicant is perceived as a trustworthy customer by the bank. However, as far as loans are considered, credibility can make or break your case. The more credible you are as a borrower, the better chances you have of loan approval and scoring low interest rates.

Another factor to remember here is that since personal loans are provided as unsecured loans solely based on the applicant’s credibility, credit score makes an even bigger impact. Consequently, a very low credit score may prevent you from getting a low interest rate or even getting approval.

As covered previously, a 500 credit score is categorised as a “very low” credit score in the UAE. Besides low chances of personal loan approval and a low interest rate, such a credit score may also make you ineligible for application. While banks do not specify the minimum credit score required to apply for their personal loan products, it remains a crucial eligibility criterion. Barring a few exceptions, almost all banks require personal loan applicants to at least have a “low” credit score to be considered eligible.

To sum up, personal loans for credit score may not be a very practical idea since you may face numerous troubles in even getting approvals. The best course of action here would be to delay your personal loan application. You can wait for a while before applying for personal loans. Meanwhile, you can try to build your credit score before you send in your application. This will ensure that you have a better chance of getting the approval as well as secure a considerably low interest rate as well. Thus, if your needs are not urgent, consider delaying your plan to take personal loans for some time.

500 Credit Score Home Loans

Similar to personal loans, it can be difficult to get a home loan with a very low credit score. Finding 500 credit score for home loans could be even more difficult since a home loan is one of the longest possible liabilities a person can avail of, with most home loans coming with a tenure of 20-25 years.

With mortgage insurance mandatory when you take a loan in the UAE, most mortgage and home loans are adequately protected by mortgage insurance plans. Additionally, most banks provide home loans only after carefully evaluating the collateral i.e., the property for which the loan is meant. The implication of all these factors is that given the additional security that home loans enjoy, the importance of other factors like the applicant’s credibility and credit score is reduced.

At the same time, it is important to remember that while you may not face any difficulty in getting your home loan approved even with a low credit score, applying for one may prove troublesome if you fail to meet the minimum eligibility criteria. While most banks do not keep credit score a qualifying factor in the list of eligibility criteria, applicants are generally expected to have at least medium or low credit scores. And, as one might remember, the category of “low” and medium credit score begins from 541 and goes up to 710.

You can always have a word with the bank directly about credit score requirements for getting a home loan and get a green light for home loans for 500 credit score. However, it is recommended to wait for a while. You can start with small steps to build your credit score a little bit and apply for mortgage loans only then. This will ensure that you get low interest rates and even discounted home loans if you are a first-time homebuyer. A strong credit score is a sure-shot way to get a low interest rate for your loan. Considering the long duration of these loans, it is in your best interest to get the lowest possible interest rates you can.

Auto Loans for 500 Credit Score

You may find it the easiest of all to get an auto loan even with a very low credit score in the UAE. Auto loans in the UAE are unsecured loans and designate the financed vehicle as collateral. Since these unsecured loans end up having certified value collateral, credibility plays a less important role here. However, since the UAE is stringent with banking rules and regulations, getting approval for your auto loan with a very low 500 credit score may still prove difficult.

Moreover, just like other types of loans, you may end up with a very high auto loan interest rate even if your application is approved. In fact, this is the reason banks always provide a certain range for their loan interest rates, i.e., to accommodate all kinds of applicants – ones with exceptional credibility as well as those with very low or only low credibility.

As a rule, it is recommended to wait for a while and build a better credit score before you file for your auto loan. You will get approved easily, score lower interest rates, and get help in attaining other kinds of credit tools like additional credit cards. Even after attaining a better credit, above 700 for instance, make sure you take care of other influential factors that play a role in deciding the final auto loan interest rate.

500 Credit Score and Insurance Plan

Since the term ‘credit score’ appears to be directly related to banking affairs, many fail to recognise its connections to other similar yet remote fields. One such field is insurance. While insurance plans, irrespective of the type, are not financing or banking products, they are still influenced by the applicant’s credit score.

As the concept of insurance is also based on risk profiling of the customers, you will get a higher insurance premium if you pose a high risk to the bank. The credibility of the applicant, thus, plays a vital role in designing the risk profile of an applicant. If the applicant has a credit score of 500, they are generally categorised as unreliable creditors.

If an applicant is an unreliable creditor, the insurance company cannot trust them to pay their insurance premiums on time. As a result, insurance premiums are increased to cover the risk factor that an untrustworthy creditor brings forth. Consequently, you will mostly get high insurance premiums for all types of insurance plans if your credit score is 500 or below. It is true that several other factors influence the final premium for insurance plans. However, credit scores still play an important role here.

Getting Loans for 500 credit score – Things to Try

As suggested previously, it is a better strategy to wait for a while and build your credit score instead of filing for a loan right away. However, if your requirements are urgent and cannot be delayed, there are a few things you can try to get the loan you require right away. Listed below are some strategies you can explore:

- Co-Borrowers: Finding a co-borrower can be a lifesaver for loans like car loans, home loans, or personal loans. if you have a 500 credit score or less, consider getting a co-borrower who has a better credit score and a steady monthly income. Most banks allow your spouse and blood relatives to become co-borrowers on personal and home loans, although you can make your spouse your co-borrower for auto loans as well. Having a co-borrower sign on with you for the loan can help you get approvals as well as low interest rates.

- Ask the Dealership: If you cannot find an external lender to finance your preferred car due to a very low credit score, ask the dealership if they have in-house financing options available. Several dealers offer such financing options although you may end up getting much higher interest rates here. The same applies in the case of private lenders as well. Even if they are willing to lend to people with very low credibility, they tend to charge higher interest rates.

- Explore Other Loan Options: Most banks and lenders offer several sub-types of loan products for every major category in their array. For instance, various car insurance providers offer different types of car loans for used cars, new cars, exotic cars, sports cars, salaried individuals, etc. You can explore such products offered by different banks and check if you can get one that suits your requirements.

Building Credit – What Can You Do to Improve your 500 Credit Score?

- Pay Your Bills: The very first step towards building a stronger credit score is to pay your dues. Besides your credit card bills, this also includes other types of bills including phone bills and utility bills. Every payment you make or miss is considered when AECB calculates your credit score. So make sure that you never lag on any payment – whether generic or credit.

- Keep Track of Credit Repayment Dates: Just like utility bills and phone bills, credit payments also come with a repayment due date. Missing these due dates or making late payments can affect your credit score negatively. Thus, it is advisable to keep a track of all your repayment dates. If you tend to miss out on payments, consider setting up auto-pay services. You can sync your credit card accounts with your current accounts and set up an auto-pay system for them. On the other hand, if you are using several credit tools with the same bank, you may be able to get the due dates shifted to a single day to make the tracking process easier. Discuss with your bank for the same.

- Diversify Your Credit Portfolio: The next step towards building a better credit score is to diversify your credit portfolio. You can consider using different kinds of credit tools. For instance, even if you are capable of buying your expensive smartphone in cash, consider doing so in 3-month equal monthly payments instead. This way, your portfolio will diversify and you can still make the payments in 3 short months only.

- Think Twice Before Closing Cards: Getting new credit cards and settling them continuously might not be the best idea. While you are advised to diversify your credit portfolio, activating new credit cards and discarding the old ones may not prove beneficial for our purpose here. Thus, you should think carefully before picking a credit card and try to stick with it for as long as possible. As an additional tip, make sure that you have a good reason for switching cards when you finally do.

- Spend Wisely: Just because your credit card has a maximum limit of, say, AED 50,000 doesn’t mean that you have to max it out every time. There is a healthy borrowing percentage that should always be maintained when you use a credit card. It is generally recommended to use 15% to 30% of your credit card limit in every billing cycle. Spending in either extreme can diminish your credit score.

- Don’t Juggle Multiple Cards: Avoid applying for multiple credit cards at once. Banks pull out credit scores every time you apply for a credit tool, and this includes both credit cards and loan products. The more your credit score is drawn out by banks, the weaker it becomes. This may result in your 500 credit score dropping even further if banks and other financial institutions are accessing it multiple times. Not to mention, juggling multiple cards at once can make it difficult to track repayment dates and maintain a healthy credit ratio.

- Abide by Your Monthly Budget: Formulating a proper budget can help you track your bills and repayment dates properly. Moreover, you can easily monitor your spending when you have a hands-on statement for all your bills. A monthly and yearly budget is one of the best things one can do to take care of their personal finances.

Key Takeaways

Now that we have covered almost all basic things about credit scores in the UAE, you can easily categorise different credit scores as very low, low, medium, high, and very high. 500 credit score in the UAE will be categorised as a very low or bad credit score. However, as explained in the previous sections, you can easily improve a very low credit score and reach the medium or high category scores.

Simply stay on top of all your payments and bills and ensure that you spend wisely. You can also reach out to our finance experts for assistance with credit cards, loans, and credit score improvement strategies. Paisabazaar.ae is always available to lend you a helping hand to manage your finances.

| Credit Score for different types of Loan | ||

|---|---|---|

| Credit Score for Personal Loan | Credit Score for House Loan | Credit Score for Car loan |

More From Credit Score

- Recent Articles

- Popular Articles