What Does a 658 Credit Score Mean?

Credit scores are seen as crucial instruments by banks and financial institutions to evaluate the credibility of an individual or a company. Your credit plays an important in deciding whether you are qualified enough to acquire a new credit facility. This is why examining and maintaining your AECB Credit Score is an important part of managing your finances. This article will focus on what a 658 credit score means for borrowers in the UAE and cover all the credit facilities that can be availed with it.

Is 658 a Good Credit Score?

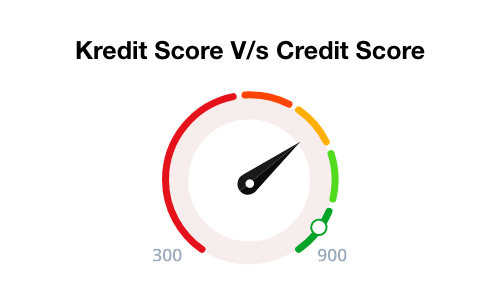

The al etihad credit bureau authorises credit scores for all UAE nationals and ex-pats. Credit scores in UAE can range from 300 to 900 points. The AECB categorises credit scores into five categories – very low, low, medium, high and very high. A 658 credit score is awarded a 3-star rating and falls into the medium category. Borrowers with a 658 credit score can generally get most credit facilities and products they desire. The next section will discuss which cr4edit facilities can borrowers with a 658 credit score are eligible to get.

What Can You Get with a 658 Credit Score in UAE?

From credit cards to auto loans and insurance premiums, several credit facilities and products get influenced by your credit score.

Let’s cover how your credit score can influence credit facilities and which ones can you get with a 658 credit score:

Credit Cards for 658 Credit Score

Borrowers with a credit score of 658 generally do not face any difficulty in obtaining credit cards. Most financial institutions and banks offer all kinds of credit cards including secured, unsecured and special benefits credit cards to such applicants. Applicants must qualify the eligibility criteria set by the bank for each individual credit card.

Personal Loan for 658 Credit Score

Obtaining a personal loan with a credit score of 658 should not be a troublesome process. Most banks allow candidates with 658 credit scores to get both secured and unsecured personal loans. However, a comparatively higher rate of interest may be charged here since a 658 credit score represents you as only a moderately creditworthy borrower. You may not be able to negotiate personal loan interest rates properly with a 658 credit score.

Homes Loans for 658 Credit Score

It may often prove challenging to get your mortgage loan approved with a 658 credit score. The reason is the high loan amount and long loan tenure associated with home loans. However, most banks will approve your application for home loans but the terms of the loans may be as favourable as you may like them to be. High interest rates, lesser loan amount and a slightly rigid repayment tenure may be a part of your loan terms.

Auto Loans for 658 Credit Score

Banks generally accept your auto loan application if you have a fair credit score of 658. However, you might be charged with a higher rate of interest on your loan as compared to candidates with high or very high category credit scores.

Insurance Plans with 658 Credit Score

Most insurance companies check your credit score to decide the insurance premium for your insurance policies. Premium rebates and discounts are offered to customers with high credit scores. If you have a credit score like 658, your provider may not offer you a substantial discount. However, any positive change in your credit score will be reflected in your insurance premiums later on.

Tips to Improve Your 658 Credit Score

It is highly recommended to improve your credit score and bring it to the high or very high category. It helps in avoiding any hindrances in getting your credit facility applications approved and also helps in scoring favourable credit terms.

Here are a few tips you can follow to improve your credit score:

Timely Bill Payments:

It is important to pay off your utility bills, credit card bills, and monthly loan instalments promptly. AECB consider 5 years of your bill payment history to calculate your credit score. Hence, always must make sure to complete all your bill payments well before the due date.

Utilise Credit Limit Wisely:

Use your credit cards wisely and well within the recommended credit limit to increase your credit score substantially. It is advised to use 10% to 30% of your maximum credit limit only. A few occasional high usage occurrences will not harm your credit score but try not to make it a habit.

Restricting Multiple Loan and Credit Card Applications:

It is advised not to apply for loans and credit cards multiple times in a short span. This highly impacts your credit score since banks pull out credit scores every time they receive a credit application. Thus, apply after conducting thorough research and try to wait for a while before reapplying after a rejection.

Limiting Regular Credit Score Check:

Constantly verifying your credit score can result in a decrement in your credit score. Ensure not to validate your credit score frequently. It is recommended to check your score every three months or so for proper tracking.

How to Check Your Credit Score for Free?

You can check your credit score using the official online and offline platforms of AECB for a certain fee. However, it is also possible to check your credit score for free at Paisabazaar.ae. We have collaborated with Al Etihad Credit Bureau to provide free credit score checks for all our customer. All you need to do is go to the website and fill out the lead form for credit cards or personal loans available in their respective sections. You will be able to view your credit score once after submitting the form.

Conclusion

So far we have established that a 658 credit score is a medium-level credit score with a 3-star rating. Borrowers with this score mostly do not face any difficulty in qualifying for credit services in the UAE. You can easily increase your 685 credit score and bring it to one of the higher categories by following a few simple tips like paying bills on time, using credit cards properly, etc. You can reach out to Paisabazaar.ae to verify your credit score for free. Proper tracking and dutifully following credit score improvement tips can bring significant changes to your credit score.

| Learn More about Other Credit Score | ||||||

|---|---|---|---|---|---|---|

| 500 | 600 | 633 | 650 | 680 | 700 | 703 |

| Credit Score for different types of Loan | |||

|---|---|---|---|

| Credit Score for Personal Loan | Credit Score for House Loan | Credit Score for Car Loan | Credit Score for Student Loan |

More From Credit Score

- Recent Articles

- Popular Articles