What is a Fair Credit Score in UAE?

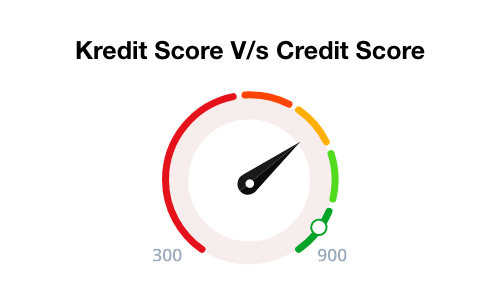

A credit score is a three-digit number that reflects your debt-paying capabilities and how good you are at money management. In UAE, it is usually a number falling between 300 and 900. Usually, financial institutions use an individual's credit score to assess their creditworthiness and the applicant's attitude towards paying off the debts on time, related risks and other defaults.

For any individual, a fair credit score signifies that their credit risks are significantly low. This, in turn, helps lenders to make a quick decision regarding loan approval, credit card issuing, and other types of financial aid.

A common question in this context is, what is a fair credit score? Continue reading to find the answer.

What should you know about the credit score?

As stated earlier, a credit score is a summary of your credit behaviour. The credit rating agencies use your credit repayment record to analyse and assign this score. Moreover, this score will determine the terms of credit in case you apply for a loan. To explain, if you have a high credit score, you will get favourable loan terms, and vice versa.

Therefore, it is imperative to be aware of your credit score. It will help you analyse and improve the score when and if needed.

What is considered a fair credit score?

In UAE, the credit score is issued by Al Etihad Credit Bureau (AECB). The AECB came into existence in 2004 to ensure transparency in all transactional aspects in the UAE. The organisation develops a credit report for all the financially active citizens of the nation by compiling several data like- transaction histories, utility bills, loans etc. Hence, any UAE citizen with these issued in their name will have a credit report and, consequently, a credit score.

According to AECB, an individual is said to have a fair credit score if they have a score of 700 and above. The table below will help you get a better understanding of the subject –

|

Score Range |

Comments |

|---|---|

|

731 and above |

Excellent |

|

680-730 |

Fair |

|

620- 679 |

Average |

|

300-619 |

Bad |

The credit score is dynamic and might change with fluctuations in the payment pattern. So, even with an outstanding track record of debt-paying capacity in the previous years, missing a few months of payment can significantly bring down the credit score.

What is the importance of a fair credit score in the UAE?

You might receive a call from a bank official, where you are offered a credit card with a higher limit. On the other hand, some might be refused a loan. In both of these cases, the credit score plays a crucial role.

In the UAE, financial institutions and lenders deploy your credit score to evaluate your creditworthiness and how well you can handle your loan repayments. Thus, they can assess if you are a good credit risk. Therefore, a fair credit score will help you secure a loan or a credit card with a higher amount limit.

What are the reasons behind the reduction of a credit score?

Here are the reasons behind the lowering of your credit score –

Irregular payment

Not paying your bills, i.e. the credit dues on time, will affect your credit score adversely, and it will go down. Hence, being diligent in repayment is essential to maintain this rating as high as possible.

Default or delay in payment, even for one instalment, can affect this score.

Total debt

Your total debt amount also plays a part in determining your credit score. This is because the credit rating agencies will look at your total debt, its type (secured and unsecured), loan tenor, and credit utilisation ratio. Therefore carrying a high outstanding can affect this rating.

Non-diversification of credit history

If your credit history does not have any diversification, it is also detrimental to your credit score. To elaborate, if your credit history only has unsecured loans, it means you are a borrower who cannot manage secured loans, and that will affect your credit score.

Closing old credit accounts

Closing old credit accounts eradicates the credit history associated with it, and that can also affect this score. So, if you have an old credit card, which you have been using for a long time, do not close it abruptly.

Frequent credit enquiries

Lenders initiate a credit enquiry about the applicant with respective credit bureaus following a loan application. Such requests are treated as hard enquiries, and they can reduce the credit score. Hence, not refraining from the practice of making multiple loan applications at one go can further reduce this score.

How to improve your credit score?

Here are some tips that can help you improve and reach the fair credit score that you are looking for –

Making on-time credit repayments

The easiest way to better your credit score is through regular payment of all your dues. This will include your credit card outstanding, loan repayments, etc.

Keeping your overall debt in check

If you manage to keep your total debt in control, i.e. in parity with your income, it will also boost your credit score significantly.

Having a mixed credit history

If your overall credit history includes both secured and unsecured credits, it projects you as a responsible borrower. Additionally, it also plays a part in improving your credit score.

Making credit applications judiciously

Loan applications initiate a verification process under which lending institutions make inquiries with credit rating agencies to learn about a borrower. These are treated as hard queries, and they can affect an individual's credit score. So, making such applications only when it is necessary can also help your credit score.

To sum up, in UAE, a credit score above 700 is considered a fair credit score. A good credit score ensures an individual's credibility when applying for credit. In addition, a good credit score has several benefits like faster loan approval, lower interest rates, better loan terms, etc. So, you can check your credit score online at the AECB website or mobile app. You can also check it on our website for free and then do the needful to maintain it.

| Credit Score for different types of Loan | |||

|---|---|---|---|

| Credit Score for Personal Loan | Credit Score for House Loan | Credit Score for Car Loan | Credit Score for Student Loan |

More From Credit Score

- Recent Articles

- Popular Articles