Emirates NBD Personal Loan Calculator

Personal Loan up to 8 times your Salary

- Minimum Salary 5000 AED

- EMI Tenure up to 48 Months

- Lowest Interest Rates

Get personal loan at Lowest Interest Rate

At times, bearing huge expenses such as educational fees, wedding expenses, or emergency funds can be difficult. In such cases, a personal loan can come in handy. With this financing option, you can fulfil your financial commitments and, in return, pay off the loan within the set loan tenure.

Various banks across the UAE, including Emirates NBD, offer personal loans. Going a step beyond, the bank even offers an Emirates NBD personal loan calculator. You can use this to estimate your monthly instalments before applying.

Let’s understand how this calculator works in detail.

What is Emirates NBD Personal Loan Calculator?

With the rise of digital technology, banks, and financial institutions are also adapting to the online world. They are incorporating online tools to make banking operations convenient for their customers. One of these includes the online calculator. Emirates NBD personal loan calculator is a free online tool that you can use to estimate your monthly instalments even before getting a loan. The ENBD personal loan calculator produces machine-generated automated results, which makes it quick and efficient.

When compared to manual calculations, the Emirates NBD loan calculator is more systematic in terms of calculation errors. In fact, it also makes calculations pretty easy, considering how human calculations can be time-consuming.

What is the Formula for Calculating Personal Loans?

While you can always use a loan calculator online, let’s quickly check out the formula for doing personal loan calculations manually -

E = [P x R x (1+R) ^ N] / [(1+R) ^ N – 1], where

- E: The monthly instalment amount to be paid

- P: The principal or the loan amount

- R: Rate of interest

- N: Loan repayment tenure

As we saw earlier, this formula can certainly be confusing and eventually increase the probability of errors. Contrary to this, the Emirates NBD personal loan calculator does not require a long calculation process.

Simply enter a few loan-related details and get the result within seconds.

In the next section, we will understand the functionality of the ENBD personal loan calculator!

How Does the Emirates NBD Personal Loan Calculator Function?

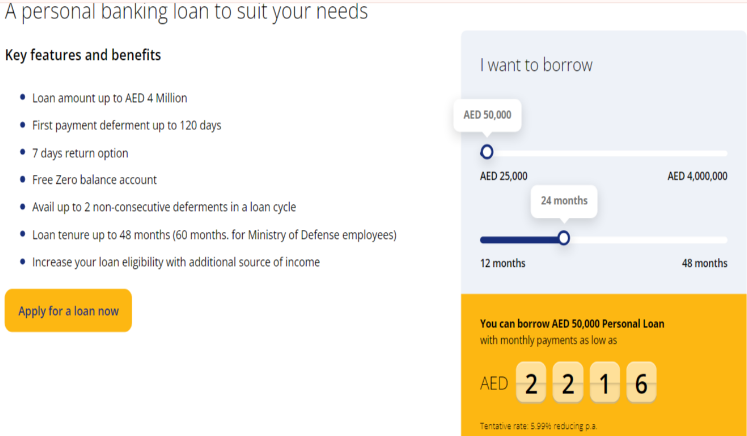

To utilise this Emirates NBD loan calculator, all you need to do is set the sliding bar up to the amount you want to borrow. Next, set up the loan repayment tenure.

The right side of the screen will display the monthly payments and total payments.

Image Source: Emirates NBD Personal loan

IMPORTANT NOTE: The generated result may not be precise due to the variation in the applicable interest rate. This is because based on your profile, loan tenure, and other criteria, the bank decides the interest rate charged on your loan. As a result, the rate can be different for each borrower.

Here are some of the primary aspects that decide your interest rates:

- Salary

- Employment Status

- Creditworthiness

- Relationship with the Lender

How to Use the Emirates NBD Personal Loan Calculator?

You can easily access this personal loan calculator UAE through the official website of Emirates NBD. Here are the steps for your reference:

- Step 1: Navigate to the ‘Personal loan’ section from the ‘Loans’ menu.

- Step 2: Select your preferred loan and access the calculator on the next page.

Alternatively, you can use the personal loan calculator on our website in simple steps:

- Step 1: On Policybazaar.ae, select ‘Personal loan calculator’ from the ‘Banking Products’ menu.

- Step 2: Locate the calculator and enter the relevant details to view the result.

Factors Affecting the Monthly Instalments of an Emirates NBD Loan Calculator

Let’s understand the top three factors that influence your personal loan monthly instalments in the UAE-

- Loan Amount - A higher loan amount results in larger monthly payments since the total borrowed sum is divided over the loan tenure. While getting a personal loan in UAE, it’s essential to consider the loan amount so that the resulting monthly instalments are within your budget.

- Loan Tenure - A longer tenure decreases the monthly payments over several months. However, this increases the total interest paid over time. On the other hand, a shorter tenure results in higher monthly payments but reduces the overall interest cost.

- Loan Interest Rate - The interest rate on a personal loan determines the cost of borrowing. Higher interest rates increase the monthly instalments, as more interest is charged on the borrowed amount. Lower interest rates reduce the monthly instalments, making the loan more affordable.

You May Also Check

| Emirates NBD Car Loan | Emirates NBD Home Loan |

In a Nutshell

The Emirates NBD personal loan calculator is a productive tool for prospective borrowers to estimate their monthly instalments. By entering key details such as the loan amount, tenure, and interest rate, you can quickly determine the amount required for a personal loan.

The calculator simplifies the process of checking different loan options, making it easier to compare and select the most suitable personal loan from Emirates NBD. This also helps in better financial planning and decision-making, ensuring proper loan terms that align with your budget and financial goals.

Personal Loan Categories

Personal Loan Bank Wise

More From Personal Loans

- Recent Articles

- Popular Articles