- How to Check AECB Credit Score in UAE for Free ?

- What is AECB?

- How to Calculate AECB Credit Score UAE?

- What is AECB Credit Score in UAE Used For?

- What does AECB Credit Score UAE Range Indicate?

- What are the Benefits of a Good AECB Credit Score?

- Factors That Can Affect Your AECB Credit Score Negatively

- What is the Difference Between AECB Credit Score, Credit Rating, and Credit Report?

- Key Terms Included in a AECB Credit Report

- What You Should be Looking for in an AECB Credit Report?

- How to Monitor Your AECB Credit Report and Score?

- How to Improve AECB Credit Score UAE?

- How to Dispute Information on your AECB Credit Report?

- What to Do if You Don't Have a Credit Score?

- What Does It Mean If Your Credit Score Has Changed?

- FAQs on AECB Credit Score

AECB Credit Score

A credit score defines your creditworthiness as a borrower in the UAE. The higher your credit score the more is your creditworthiness and vice versa. You can easily check your AECB credit score in the UAE for free on Policybazaar.

AECB Credit Score is a three-digit number (300 to 900) that predicts how well you have managed credit, like a home loan or personal Loans on time. AECB Credit Score plays a critical role in the Loan Approval Process. The higher the Score higher your chances of Loan Approval.

How to Check AECB Credit Score in UAE for Free ?

Policybazaar.ae in collaboration with AECB gives you a chance to check your AECB Credit Score Free. All you need to do is just enter few basic details on above form or click on below banner to get your AECB Credit Score for absolutely free.

What is AECB?

AECB, a financial institution, collects credit data from banks, financial institutions, and non-financial institutions.

As a Public Joint Stock Company, it is owned and operated by the Federal Government of the UAE. After collecting credit information from the concerned organisations in the country, it prepares AECB reports and credit scores.

As we saw earlier, you can check your credit score for free on this platform. To check your credit report, however, you need to visit the official AECB website and pay a small fee.

How to Calculate AECB Credit Score UAE?

Your AECB credit score in UAE is calculated as per the following factors —

Payment History

Age of Your Credit History

Credit Mix

Credit Activity

Usage of Credit

Payment history is the most important parameter for your AECB credit score, weighing up to 35% of your score. This refers to whether you’ve made all your payments — whether for credit cards, loans, or utility bills — on time.

This refers to how long you’ve used credit instruments. Generally, the higher the age, the better your score.

For a good mix and an improved AECB credit score, it’s important to have different types of credit instruments like credit cards, loans, and so on.

Each application for credit cards or loans leads to hard inquiries on your score. While one or two such inquiries may not affect much, multiple inquiries can bring down your AECB credit score.

Another key factor, it shows how much credit you’re using versus your total credit limit. For a better score, it’s advisable to keep this utilisation low.

What is AECB Credit Score in UAE Used For?

Check out the common uses of UAE Credit score —

- By banks when reviewing your application for loans or credit cards

- When deciding the loan amount or credit card limits

- By home rental agencies and other similar organisations

- When you apply for unsecured loans

- Employers (may require credit report checks)

What does AECB Credit Score UAE Range Indicate?

Tabled below is a general overview of the ratings for the credit range in UAE and what your AECB credit score indicates :

| Credit Score Range | Stars Allotted | Category Allotted |

|---|---|---|

| 746 to 900 | 5 | Very High |

| 711 to 745 | 4 | High |

| 651 to 710 | 3 | Medium |

| 541 to 650 | 2 | Low |

| 300 to 540 | 1 | Very Low |

What are the Benefits of a Good AECB Credit Score?

With a good credit score UAE, you can enjoy the following advantages across various domains —

Easy Approvals for Credit :

Generally, with a good credit score in UAE, you can enjoy easier approvals for your loan and credit card applications.

Low-Interest Rate on Credit Cards and Loans :

High credit scores indicate better creditworthiness, which is often rewarded by lenders via low credit card and loan interest rates. This way, you can easily access credit without facing the burden of heavy interest.

Ease in Renting Apartments :

Did you know that your credit score can also be useful when searching for apartments for renting?

As per reports, the Dubai Real Estate Centre uses credit reports of the Al Etihad Credit Bureau to check the financial standing of potential tenants. In fact, FAB Properties, the real estate management arm of the First Abu Dhabi Bank group, also uses AECB’s data to assess tenants.

Employment Opportunities :

High credit score UAE can also prove beneficial when you want a new job.

As per reports, employers may check your credit report to know how well you manage your credit. So if you’ve a good report, it can certainly be useful if you’re looking for a new job or want to make a switch.

Factors That Can Affect Your AECB Credit Score Negatively

AECB credit score UAE might be adversely affected by the following behaviors:

- Late Payments: Even if one payment is delayed for more than 30 days, the credit score uae might suffer. The non-payment window is used to notify credit reporting bureaus of the delay, and this can adversely affect a uae credit score.

- Applying for more credit several times: Each time that you ask for credit, a hard credit inquiry shall be made on the account. Every hard inquiry shall affect the credit score UAE, even when the approval is not granted.

- Canceling your zero balance credit cards: If a cardholder decides to do away with a credit card, it might adversely affect their score. Cancelling a credit card reduces the total credit amount, which in turn increases the credit utilization ratio. It also shortens the credit history period.

- Transferring the balances to a single card: It makes sense to carry just one credit card around, protecting against risks of theft, and general maintenance of multiple cards. However, transferring your credit balances consolidated into one card may not be advisable. The upward balance that will be created on the card will cause credit utilization to shoot up drastically, which will hurt the credit score UAE.

- Giving authorization to relatives with unreliable credit scores:It is your choice if you wish to co-sign your account with a friend or a family member in need. Co-signing means you are responsible for their debt, and in case they default on payments from this account as well, you are bound to suffer a depreciation in your own uae credit score.

| Credit Score for different types of Loan | |||

|---|---|---|---|

| Credit Score for Personal Loan | Credit Score for House Loan | Credit Score for Car Loan | Credit Score for Student Loan |

What is the Difference Between AECB Credit Score, Credit Rating, and Credit Report?

| Parameter | Credit Score | Credit Rating | Credit Report |

|---|---|---|---|

| Definition | A three-digit number between 300 and 900 as per your creditworthiness | Expressed alphabetically such as AA, BB, CC, and so on. | Detailed report of your credit history, score, and more. |

| Available for | Individuals and corporations. | Mainly businesses and Governments. | Individuals and corporations. |

Key Terms Included in a AECB Credit Report

Some of the key terms to be mindful of when reading your AECB credit report are:

- Annual Percentage Rate or APR: It is the yearly cost that is incurred on the amount that is being financed, including the interest and the fees that are chargeable on it, expressed in terms of a percentage rate.

- Consumer Credit: The debt that is incurred by a user to purchase a good or service for personal or family purposes. This shall include any purchases that are made on credit cards, and other lines of credit.

- Credit Scoring Model: This is be based on an objective mathematical formula, used to gauge the consumer’s creditworthiness from his or her AECB report. The algorithm that is specifically being used by the AECB takes into consideration several attributes such as outstanding balances, number of loans and so on.

- Debt management: Any strategy that comes in useful for managing the debts that have been accumulated on the credit card, whether they are based on offers available from the company itself, or behavioural habits adopted by the user.

- Revolving Account: An account that establishes a maximum credit limit for a consumer. The balance shall be carried over from one month to the next and is liable to incur interest. Payment amounts shall be based on the outstanding balance amount.

What You Should be Looking for in an AECB Credit Report?

- Credit Summary: You need to study your AECB credit score uae which has a star rating this shows whether it is a good score or bad.

- Correct Address: The residential address does not make a difference to the score, nevertheless, it should be carefully verified by the cardholder, lest the report is later delivered to an incorrect address.

- Employer Information: While this information has no direct bearing on the score, this detail could be checked by prospective lenders in order to decide whether the loan applicant is worthy of the same or not.

How to Monitor Your AECB Credit Report and Score?

Credit monitoring refers to the routine checking of your credit history, in order to keep an eye out for any suspicious activities or discrepancies. You can do this either by checking your AECB credit report online or requesting routine mobile alerts regarding the same.

How to Improve AECB Credit Score UAE?

Following are some of the steps that you may take to improve your credit score in UAE:

- Go for Long-Term Loans: A key component of your credit score is the age of your credit history.

With long-term loans, you can elongate your credit line and improve your Etihad credit bureau score. Instead of changing your credit cards frequently, hold onto one for a long time. - Diversify Your Credit Line: Your credit mix is another factor affecting your score. If you have already taken an unsecured loan and plan to take another one, try for a secured loan this time. Diverse credit accounts can improve your AECB credit score as well.

Similarly, if you only have a loan, you can get credit cards for yourself -

Maintain lower credit usage: Try to maintain a lower credit utilisation ratio. This figure is simply the percentage of the credit you’re using against the total credit available to you.

Tip: It’s advisable to keep this ratio below 30% for a good credit score.Example

Let’s say your credit card limit is AED 10,000. If your total outstanding amount is AED 2,500, your utilisation ratio will be 25%.

Use your credit card up to the recommended limit only and always pay it back on time.

You can also request a higher credit limit: This way, even if you keep your expenses the same, your credit utilisation will be lower.

- Timely payment of bills: Of course, apart from all the strategic measures that you can take, it is always advisable to take care of the basics first. Taking care of the dues on your utility bills and so on that are outstanding on your credit card, and ensuring that there are no delays is after all the most important criteria to be fulfilled.

- Remove collection accounts from the card: In case the credit card is being used to make payments to a collection account, the cardholder may take the call to get rid of it. They may be too old or may be inaccurate, and it may not make sense to keep them as a drain on the existing credit card account.

- Become an authorised user: In case a relative whom you trust has a good credit history by having a flawless record of on-time payments, you may request their permission to become an authorised user. This means that that specific account, which enjoys a good credit evaluation, will be added to your credit account, and its credit limit can be used for your utilization.

- Get the Errors Rectified: Since the report is a collection of several small components, a few errors may sneak into your credit history. If you find any such errors which are affecting your AECB credit score negatively, get them corrected by contacting the AECB support centre. Your concern will be raised with and resolved by the concerned information provider.

How to Dispute Information on your AECB Credit Report?

AECB takes information regarding your financial history from banks and financial institutions. In case of any error in providing information from that end, your AECB credit report may have errors.

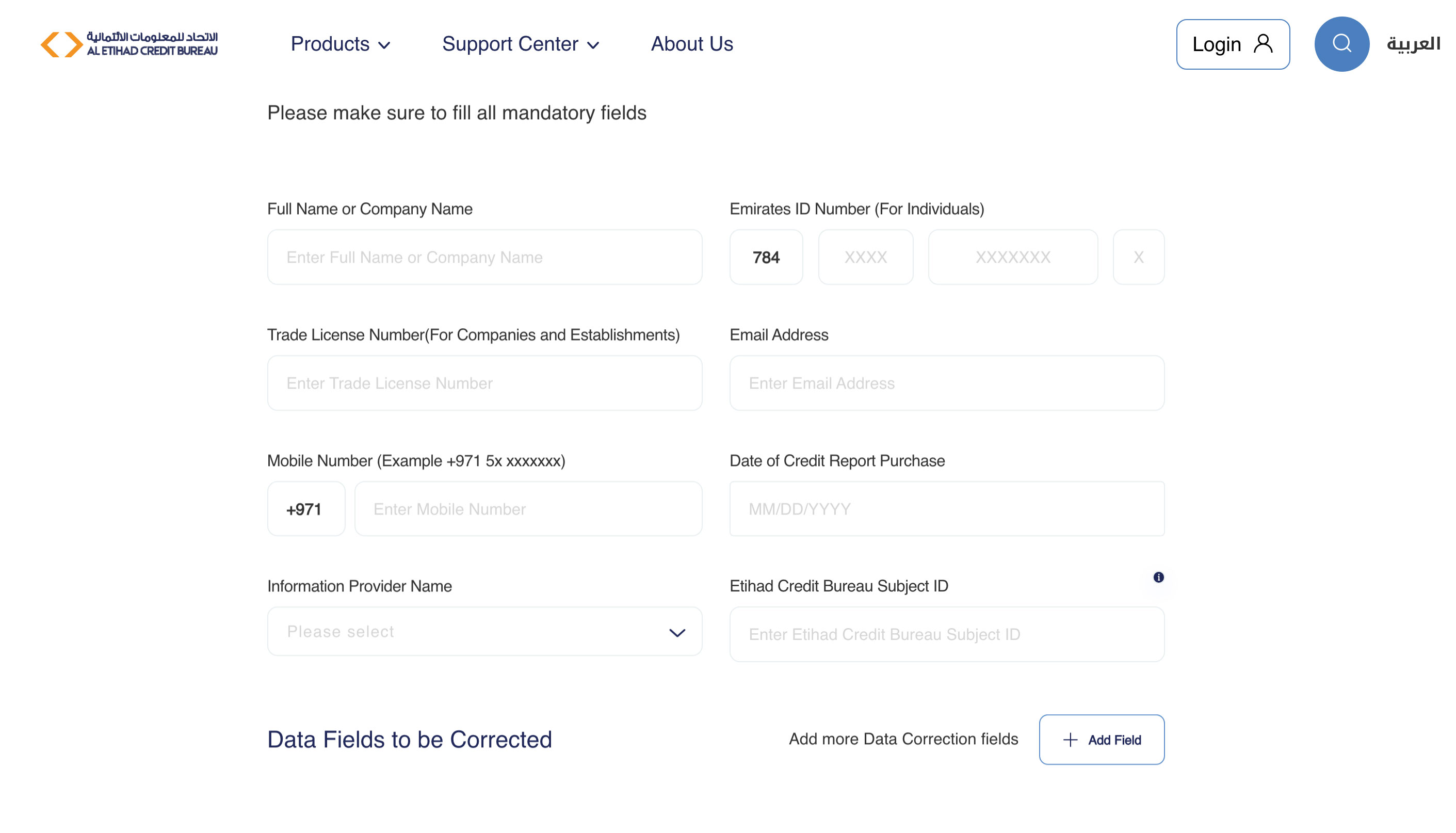

To dispute any details on your AECB report, you can visit this link — https://etihadbureau.ae/correction. Here, you can make a ‘Data Correct Request’ through the form that looks like this —

For this, you will need details and documents such as —

- Emirates ID number

- Mobile number

- Correction details

- Supporting documents

For further enquiries, you can connect with the AECB by dialling 800 287 328. Alternatively, you can visit any of the AECB customer experience centres in Dubai or Abu Dhabi.

Important

- As per the guidelines of the UAE Central Bank, data providers must respond to the requests within 10 working days.

- While the usual period for dispute redressal is usually 20 working days, the actual time may depend on your individual circumstances.

What to Do if You Don't Have a Credit Score?

If you check your credit score UAE but find that you don’t have one, it could be the case due to these reasons —

- You have not applied for or used any credit cards or loans till date

- No utility bills have been registered in your name

- Prolonged inactivity — if you closed your credit accounts long time back and haven’t used any credit since

If this is the case, the steps to get your score back are pretty much the same as those to improve your score —

- Pay utility bills on time

- Become an authorised user on someone else’s credit card

- Get a small loans that you can easily repay

What Does It Mean If Your Credit Score Has Changed?

Were you taken aback by surprise to realize that your credit score in UAE has changed since the last time you checked? You must understand the reason to take the necessary steps to bring your score back up to the mark if it experienced a slump.

Although the reasons may vary, you can check some of the common reasons for getting a bad credit score below —

- Negative Marks on Your Credit Report: This happens if you fail to honour some outstanding loan. In this case, a bank or a credit issuer might place a mark due to late payment, bankruptcy, a lawsuit being filed and so on.

This should be taken seriously as the mark can remain on your account for long time. - Reduced Credit Limit: Lowered credit limit means a higher credit utilisation ratio. In such a case, you need to check the credit limit that you’re using in a month.

- Closure of a Credit Card: When you close a credit card, the available credit amount is reduced. Consequently, if you don’t cut down your monthly spending, your credit utilisation ratio is bound to shoot up. In fact, the second problem would be that closure would bring down the average length of your credit history, which again hurts your score.

- If You’ve Applied for Multiple Lines of Credit: When you apply for a credit product, a hard inquiry is pulled. This can bring down your credit score.

While one or two such inquiries may not dent your score much, multiple applications at a time can hurt your score. - Identity Theft: The final reason might be a serious cause for concern — it could be possible that someone has stolen your credit card or made applications for credit accounts in your name.

While a drop in credit scores doesn’t automatically imply this is the case, it’s always good to check this is not the scenario. In case of identity theft, immediately get in touch with your credit card provider and have get the matter addressed at the earliest.

FAQs on AECB Credit Score

Ans: Your AECB credit score is a 3-digit number between 300 and 900. It indicates your creditworthiness - the higher your score, the better your credit history. This score is calculated by the AECB, which provides credit reports and scores to both individuals and companies in the UAE.

Ans: No, you cannot improve your AECB score in a month. The process is gradual and takes time. In the meantime, make sure you pay your bills and debt off on time and use your credit card below the utilisation ratio.

Ans: You can check your credit score for free on Policybazaar.ae.

Ans: Telecommunication companies can check your credit score to understand your creditworthiness, especially if you are out there to get a postpaid number.

Ans: AECB considers several factors to compute your credit score — your payment history, debt-burden ratio, bill payment, the number of credit applications you make, and more.

Ans: In case you find any faults in your credit report, you can connect with AECB to raise a dispute.

Ans: Regularly missing or delaying payments, bouncing cheques, holding multiple loans and credit cards, or frequently reaching your credit card limit will result in a reduced credit score.

Ans: Your credit report contains important details such as your past and present loans, your payment history for up to 5 years, any late payments you've made, and details about defaults and bounced cheques. It's like a snapshot of your borrowing and repayment behaviour that lenders use to assess your creditworthiness.

Ans: The credit report shows your financial obligations to the banks, civil bodies, and other creditors. This helps banks and other financial institutions determine your creditworthiness before approving your credit card or loan application.

More From Credit Score

- Recent Articles

- Popular Articles