- What is Family Health Insurance?

- Top Family Health Insurance Plans in UAE

- Why Do You Need Health Insurance Plan for Your Family?

- What Factors are to be Considered before Buying Family Health Insurance in Dubai?

- Family Health Insurance Plan Inclusions

- Family Health Insurance Plan Exclusions

- Eligibility of Family Health Insurance UAE

- Compare Different Family Health Insurance Plans in UAE

- How to Buy the Best Health Insurance Plan for Family?

- How to Claim Your Family Medical Insurance in Dubai?

- How to Renew Family Health Insurance Plan in UAE?

- Family Health Insurance FAQs

Family Health Insurance Dubai

You can get a family health insurance plan to cover your loved ones against any medical situation. These plans offer benefits like cashless hospitalisation (covering all the procedures including doctor consultations), ICU charges, operation theatre costs, maternity benefits, dental cover, and more. ...read more

What is Family Health Insurance?

Family health insurance is a kind of health insurance that gives you insurance coverage for both you and your family. Some of these plans also cover your extended family.

Family medical insurance plans provide you quality healthcare in some selective hospitals and cover all your medical expenses on a cashless or reimbursement basis.

Choose Best Family Health Insurance in UAE

Secure Your Family's Financial Future with Reliable Family Health Insurance

Overview of Family Health Insurance |

|

|---|---|

|

Parameters |

Features |

| Family Health Insurance Cost |

AED 32/ Day* |

| Maximum Medical Cover |

AED 7,350,000 |

| Minimum Entry Age |

0 Days |

| Maximum Entry Age | 99 Years |

|

Emergency Treatments |

Covered |

| New Born Cover Coverage | Covered upto 30 days |

| Top Insurers | Sukoon Insurance, Takaful Emarat, Adamjee Insurance, Dubai Insurance, Orient Insurance, ADNIC Insurance, Daman Insurance, and more |

|

Policy Tenure of Medical Family Insurance in UAE |

Generally, purchased for 1 year and can be renewed on an annual basis |

| Coverages Included in Family Insurance in UAE |

|

| Exclusions |

|

| Cashless or Reimbursement Claim | Covered |

*The premium of family health insurance in the UAE varies significantly based on several factors, including the insurance provider, the level of coverage, the number of family members, and their ages. Additionally, premiums may differ based on the specific benefits and add-ons chosen.

Top Family Health Insurance Plans in UAE

Here are the best family medical insurance plans in Dubai, UAE:

| Plan Name | Medical Cover (AED) | Pharmacy Limit | Price |

|---|---|---|---|

| Orient Insurance - Gold - Family Care Plan A | 1,000,000 | Upto Medical Cover | View Quotes |

| Takaful Emarat - Rhodium | 1,000,000 | Upto AED 15,000 | View Quotes |

| Watania - Gold - Family Care Plan A | 1,000,000 | Upto Medical Cover | View Quotes |

| Alliance - Universal Plus Plan | 500,000 | Upto AED 10,000 | View Quotes |

| DNIRC Gold - Plan A | 1,000,000 | Upto Medical Cover | View Quotes |

| View More Plans | |||

Why Do You Need Health Insurance Plan for Your Family?

Here are a few compelling reasons that’ll make you realize that family health insurance is not a nuisance, rather a necessity. Let’s take a look at why you might need one for your family:

Cashless Hospitalization: With a health insurance plan in place, you can have your family treated in world-class facilities without worrying about the cost of treatment. Let’s imagine, one of your family members gets sick and needs urgent medical intervention and surgery. If you have medical insurance, these emergencies are taken care of very well. You can go for a cashless hospitalization to one of the network hospitals and get your loved one treated without worrying too much. However, if for some reason, your chosen hospital doesn’t fall under your insurance provider’s network, you can easily get a reimbursement for the expenses that you bear.

Financial Protection: You have the option to go for a family health insurance plan that takes care of all your medical bills eliminating the need for paying out of pocket.

Safety and Security: Family health insurance plans come with numerous benefits. They have lower rates and higher advantages that continue to cover you and your family for the prescribed tenor.

Quality Treatment: As we all know medical expenses are not limited when it comes to going for treatment. They include various medical expenses like doctor's consultation, diagnostic tests, medicines, hospital room rent, operation theatre costs, ambulance charges, etc., and continue to increase.

What Factors are to be Considered before Buying Family Health Insurance in Dubai?

There are a few things that you must consider before buying the best health insurance for your family. Here’s a list:

- Check if the claim process is simple. The simpler it is, the faster the claims are processed.

- Select the sum assured wisely as it covers the medical expenses for the whole year. Keep in mind that the younger you are, the lower the premiums.

- It is important to keep the age and medical history of your family members in mind when you’re choosing a health insurance plan in the UAE.

- Always choose the health insurance plan that comes with maternity benefits. Check the waiting period applicable and consider the sub-limit.

- Check the list of hospitals where you get cashless hospitalization. Always choose an insurance provider that has a high number of network hospitals.

- Make sure you go for a health insurance dubai plan that offers lifetime renewability. People usually get caught by diseases in old age.

Family Health Insurance Plan Inclusions

The best medical insurance for the family includes:

- Hospital room charges

- Doctor consultations

- Operation theatre charges

- ICU charges

- Daycare procedures

- Ambulance charges

- Maternity benefits

- Dental cover

Family Health Insurance Plan Exclusions

A common family health insurance plan excludes-

- Pre-existing diseases

- Infertility-related treatment

- Cosmetic surgeries

- Sports-related injuries related

- Injuries suffered in some criminal activity

- Addiction treatment

Eligibility of Family Health Insurance UAE

All UAE residents and nationals are eligible for any basic health insurance plan available in the country and that includes family-specific plans as well. Irrespective of the age, everyone shall be covered in the family plan, whether it is an individual personal plan or insurance offered by the employer. However, the number of dependents may vary as per the insurance provider that you choose. All you need to do is read the terms and conditions of the selected plan carefully to know the kind of coverage that’s being provided in the plan.

Following are a few eligibility details that you will need to keep in mind when buying family health insurance:

- While the applicant has to be of 18 years of age or older, the dependents in a family plan can be anyone who has all the valid documents to prove dependency on the applicant and their familial relations.

- You can include a new family member in the same family insurance at any time without an additional premium as long as it is under the specified limit.

- Even after you have reached the maximum number of dependents to include in a family insurance plan, you can still opt for additional members to include with an added premium rate.

- There is an upper age limit on the children who are included as dependents in a family insurance plan. The age bar differs for every insurance provider but children under 18 years of age are to be included as dependents in a family health insurance plan.

- Most providers offer combined claims for the whole family. This means that if one member happens to exhaust the claim limit, the family insurance policy expires right there.

- Senior citizens are eligible to be included in family health insurance plans but it may come with an increased premium since insurance companies see senior citizens as high-risk customers.

Compare Different Family Health Insurance Plans in UAE

Here is a simple process that you can follow to buy the cheapest health insurance for families in the UAE.

- Discover Your Needs and Find a Suitable Plan: To buy a useful family insurance plan, you must know what your needs are. Calculate the coverage amount that would be sufficient for you and your family.

You need to consider each family member’s needs in mind and opt for a plan that’s closely aligned with your needs. Compare the prices, check out the benefits, and shortlist the family insurance plans based on your medical requirements. - Check the Insurance Provider’s Records: After you have compared the prices of different insurance providers and chosen the one you are going to buy your insurance from, perform thorough research on the insurer’s claim settlement ratio, customer experience etc.

Check out the number of years the company has been in the insurance business, the claim settlement rate that they offer, the benefits they provide, etc., and make an informed decision thereafter.

Perform thorough research and check out the inclusions and exclusions of the plans. Do not forget to go through the customer reviews to find out the nature of the service provided. - Go through the List of Network Hospitals: Make sure to check out the list of network hospitals and see if your preferred hospital is included or not.

- Check the Claim and Renewal Process: The insurance claim and renewal process must be smooth. Find out in advance if the process is quick and simple or not. This will come in handy when it’s time for you to get your insurance policy renewed.

- Proceed to make a purchase: Now, when you know almost everything about your insurance provider, you can proceed with buying a plan of your liking. It all depends upon the modes they are offering. If they allow you to buy insurance online, just go to the portal, submit the required documents, and make the payment. Or else, you can simply visit the branch and make a purchase.

How to Buy the Best Health Insurance Plan for Family?

Here is a simple way to buy the best health insurance plan for your family.

- Visit the Online Portal: Begin by visiting the online portal of your chosen insurance provider. Look for a suitable plan and check out its details. Many insurers allow you to book a callback from their representatives who can help you through the whole buying process.

- Go through the Benefits: You must know what your insurance plan offers and how is it beneficial for you. Make sure you go through all the details before you submit your documents.

- Upload the Required Documents: Just select your favorite plan and upload the required documents to finalize the purchase.

- Get the Cover: Once done with the documents submission process, you must go ahead and make the payment of the insurance premium amount.

How to Claim Your Family Medical Insurance in Dubai?

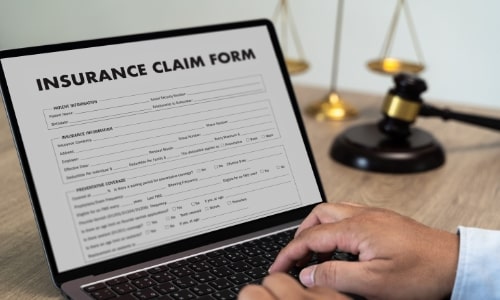

The process to claim your medical insurance for your family is as simple as the one for buying it. Here are the simple steps that you can follow to register your claim.

- Report the Claim: First, you need to go to your insurer’s website and report your claim.

- Submit the Documents: Provide medical proofs in form of documents and bills followed by submitting the bill.

- Wait for the Approval: It usually takes 15-30 days to get the final approval. Just sit back and wait for the approval.

How to Renew Family Health Insurance Plan in UAE?

Follow these simple steps to renew your health insurance plan.

- Give Your Details: Get in touch with your insurance service provider and give your policy details like your policy number and the expiry date.

- Payment: Make the payment of your premium to renew the policy. Once done, get the digitally signed copy of your policy issued.

- Check the Policy Details: You can, later on, check the details of your policy to find out if it has been renewed successfully.

Family Health Insurance FAQs

Family medical insurance plans help you in keeping your family safe. Taking a family health insurance is cheaper in comparison to buying individual insurance plans for each family member.

A health insurance plan covers your family’s treatment expenses and gives you enough financial strength if a medical emergency comes up. Buying a healthcare insurance plan is the best precaution you can take to meet all your medical requirements for both you and your family.

Here is the list of documents required for a family insurance plan.

- Identity, age, and address proof of all the members

- Income proof of the policyholder

- The proposal form

- A few medical tests (applicable in some cases)

A regular insurance policy allows you to add new members at the time of renewal. However, the dependents can be added anytime except for newborns.

Yes, you can switch hospitals during treatments. However, you need to inform your TPA department and let them evaluate your case based on the terms and conditions of the policy.

You get a fixed sum insured for a policy term and you can use this amount whenever you avail of any medical services. If the sum insured gets exhausted by one member, no other member can avail of it until the policy gets renewed.

Popular Searches:

Health Insurance Dubai | UAE Medical Insurance Prices | UAE Insurance With emirates-id | Best Health Insurance in UAE | Health Insurance for Parents | Maternity Insurance UAE | Health Insurance for Child in UAE | Dental Insurance in UAE | Online Individual Health Insurance | Health Insurance in Abu Dhabi | Health Insurance in Sharjah

Other Insurance Products

Car Insurance | Term Insurance | Life Insurance | Investment plans in UAE | Travel Insurance | Best Car Insurance in UAE | Life Insurance Companies in UAE | Mutual Funds UAE | Short Term Investment UAE | Sip in UAE | Term Insurance Calculator

More From Health Insurance

- Recent Articles

- Popular Articles