- What is Fire Damage?

- Does Home Insurance Cover Fire Damage in the UAE?

- What is Covered Under Home Insurance Fire Damage?

- Exclusions Under Home Insurance Fire Damage in UAE

- Home Insurance Claim Process for Fire Damage

- How to Choose the Best Home Insurance Covering Fire Damage?

- Why You Should Purchase Home Insurance Fire Damage from Policybazaar UAE?

- Frequently Asked Questions

Does Home Insurance Cover Fire Damage?

As we know, a small fire can quickly turn into a catastrophe. In fact, in recent years, the UAE has observed an increase in residential fires. For homeowners, such fires can bring significant financial losses. However, with home insurance fire damage cover, you can have financial security for such ...read more

- Instant Issuance

- Personalised Expert advice

- Guaranteed Low prices

Home Insurance starting at AED 33/day

Having the right home insurance is a wise investment, as it offers coverage against various uncertainties. If you are not sure and wondering ‘Does home insurance cover fire damage? This guide will provide clarity and help you understand how fire damage is handled under standard home insurance policies.

What is Fire Damage?

Fire damage is the destruction of property, building structure, content, and more caused by an uncontrollable fire. This damage can arise from various incidents, including natural calamities, electrical failures, accidents, and more.

Addressing fire damage with the right home insurance is crucial as it prevents structural damage and ensures the safety of our valuable investment home.

Does Home Insurance Cover Fire Damage in the UAE?

Yes, home insurance in the UAE generally includes fire damage coverage that comes under the ‘Fire and Allied Perils’ section. This plays a critical role in safeguarding homeowners from financial risks, covering the cost of damage and loss triggered by a ruinous fire.

A comprehensive home insurance policy can compensate for the losses and helps restore your home to its previous condition. Along with this, you can enjoy other significant benefits, such as coverage against theft, vandalism, accidental damage, and more giving you peace of mind and financial security during unexpected events.

You should also keep in mind that the scope of coverage can vary from provider to provider. So, it’s important to check the home and fire insurance coverage.

What is Covered Under Home Insurance Fire Damage?

With a comprehensive home fire insurance plan, you can get coverage for your property/building and content inside the house. The following coverages are outlined in the table below:

| Building Fire Coverage | Content Fire Coverage |

|---|---|

|

|

Note: Each policy may have different coverage features — it’s suggested to carefully read your policy document

Exclusions Under Home Insurance Fire Damage in UAE

The common exclusions under home insurance fire damages are as follows:

- Loss/damage of buildings caused by scorching, melting, etc.

- Unoccupied or vacant house for a long time (usually more than 60 days)

- Loss/damage by family members

- Loss or damage not reported to police

- Intoxication and use of drugs

- Wear and tear

- War and terrorism

- Radioactivity and sonic bangs

- Pollution and contamination

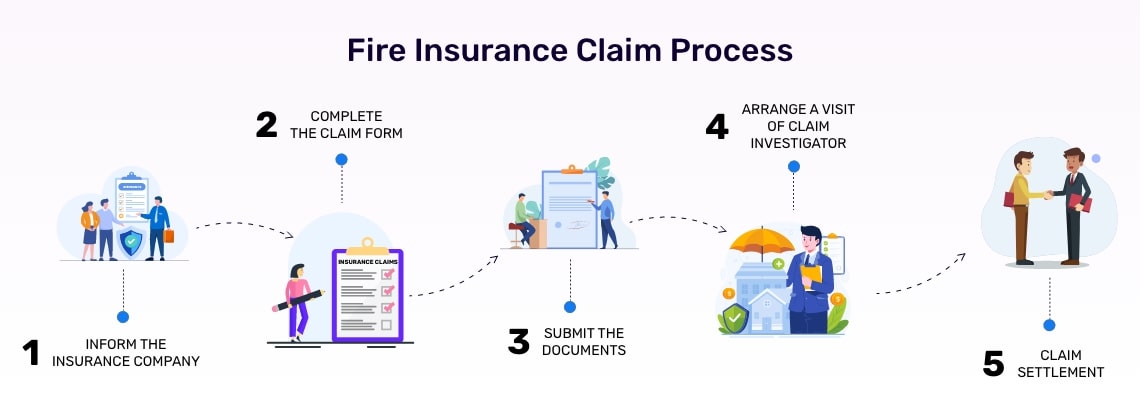

Home Insurance Claim Process for Fire Damage

Filing a claim for home insurance fire damage can be easy and simple by following the steps mentioned below:

1.) Collect the Fire Damage Evidence

While claiming against your home insurance policy, you need to submit some supporting documents. If feasible, take pictures and videos and collect the details of loss/damage due to fire.

2.) Immediately Contact Home Insurance Provider

It’s important to inform the home insurance company as soon as possible after the fire incident. This way, you can start your claim process quickly and get the required guidance from the provider.

3.) Documents Submission

You need to submit some required documents while making a claim against the home insurance policy. Common documents include fire damage evidence, policy documents, police reports, and more.

4.) Claim Investigator Visit

After starting the claim process, the home insurance company will send a claim investigator to assess the extent of the fire damage. The investigator may ask for some additional information or documents to support your claim, so cooperate with them accordingly.

5.) Get the Claim

Once the claim settlement process is complete, you will get the compensation amount in your bank account or by any other method.

How to Choose the Best Home Insurance Covering Fire Damage?

We have mentioned the key considerations that you should weigh before buying home and fire insurance in the UAE:

- Reputation of Home Insurer: Read online reviews of home insurance providers to check their reputation in the industry. Positive customer testimonials can help you find the best home insurance provider with fire damage coverage.

- Coverages: Look at the coverages under home insurance fire damage, as different plans offer different coverages.

- Add-Ons: By choosing add-ons on your basic home insurance plan, you can enhance the protection of your home. So, look at the add-ons offered by the insurer.

- Exclusions: Always check the exclusions of your home insurance policy before making a purchase.

- Transparent Quote: Opt for a home insurer that provides clear, upfront pricing for home insurance. Avoid hidden fees or unexpected charges by comparing quotes of different providers.

Why You Should Purchase Home Insurance Fire Damage from Policybazaar UAE?

Buying the right home insurance with fire damage coverage may be difficult for you, but with Policybazaar UAE, you can make the process simple and easy. As a leading online platform, Policybazaar allows you to find the best home insurance coverage, comparing the features and benefits of the different companies.

With Policybazaar.ae, you can enjoy significant privileges:

- Affordable home coverages

- Instant home insurance

- Expert guidance

- Claim assistance

Frequently Asked Questions

Any damage/loss caused by fire, whether it’s building or contents damage, is covered under a fire home insurance policy.

A comprehensive home insurance policy usually covers fire damage in the UAE. However, if you want to add riders or add-ons to your basic plan, then you may need to pay extra.

No, it’s not mandatory, but it’s highly advisable to buy home insurance with fire damage coverage to protect your home from uncertainties.

More From Home Insurance

- Recent Articles

- Popular Articles