How to Get a Credit Card for a Salary Below AED 6000 in UAE?

At present, credit cards are inevitable for our daily finances and purchases. Initially, the cards were the source of short-term loans but gradually grew to be the best shopping tool. Since the demand increased, banks in the UAE started competing to offer the most affordable credit cards. The minimum salary to obtain a credit card is AED 5,000, and no financial institution offers credit cards below this mark. With a salary of AED 6,000, you can afford several credit cards in the UAE. However, these cards will offer you basic services and privileges.

Before applying for a credit card, you need to ensure timely payment of the annual fee, other charges, including your credit card bills. The article below describes ways to avail of a credit card with a minimum salary of AED 6,000.

Ways to Get Credit Cards with a Salary Below AED 6,000 in UAE

Numerous credit cards are available for individuals with a salary above AED 5,000. So, a salary around AED 6,000 or slightly below can fetch you a credit card in the UAE. Before getting a credit card, you need to research extensively and compare all the available options to find the best credit card in UAE under your budget. Different ways to get a credit card below AED 6,000 salary are as follows.

- Applying at the Bank’s Portal - After you have compared various credit cards below the salary of AED 6,000, visit the bank’s online portal and choose your credit card and click on the Apply Now button. Subsequently, enter your contact and personal details. The bank will contact you for the further application process. Several banks like Mashreq Bank provide a completely online application and offer virtual credit cards in a few simple clicks.

- Applying at the Bank’s Branch - At your convenience, you can always visit the bank branch with the requisite documents to apply for a credit card in the UAE. The process is slow and may take up to 7 working days for your application to get processed. Additionally, it would require time and effort. However, if you have decided to visit the bank, you can locate the nearest branch by visiting their official website.

- Applying at Policybazaar.ae - Policybazaar.ae brings all the credit cards in UAE under one place, you can compare various credit cards for a salary below AED 6,000 and apply conveniently. In addition, you can resolve your credit card related issues conveniently by contacting our support team.

Things You Should Know Before Getting a Credit Card for a Salary Below AED 6,000 in the UAE

Under AED 6,000 salary, you may find numerous conventional and Islamic credit cards in UAE. Within the available options, you may consider various rewards and cashback credit cards that are affordable and have lenient eligibility criteria. You should consider the following things when applying for a credit card below a monthly salary of AED 6,000. =

- Credit cards with low salary requirements may not offer you many lifestyle, entertainment and travel benefits.

- Usually, with such a salary, you can avail of cashback and rewards cards that offer you loyalty points on each purchase. You can redeem these points to get extra discounts on shopping and various other expenses.

- While researching various cards, look for free for life credit cards in UAE since they do not levy annual membership charges and have relatively lower finance charges than other credit cards.

- Also, ensure that you can pay the credit card bills without delay as non-payment of bills may lead to unwanted charges (penalties).

- While selecting a bank, look for ease of paying credit card bills and convenience in controlling your card expenses.

- Finally, you should look for other services such as balance transfer facility, cash advances, purchase protection and extended warranty to secure your card transactions and manage expenses conveniently.

Top Credit Cards for a Monthly Salary on AED 6,000 in the UAE

Several banks and financial institutions in UAE offer credit cards between a monthly salary slab of AED 5,000 to 6,000. To ease out your research, we bring the best credit cards in the UAE below AED 6,000 salary. Following is the rundown of various cards, their annual fees, requirements, and benefits.

Citibank Simplicity Credit Card

Citibank Citi Simplicity Credit Card

-

Minimum Salary AED 5,000

-

Annual Fee Free For Life

- Travel Insurance

- Airport Lounge Access

- Purchase Protection & Extended Warranty

- Dining Benefit

- Free for life

Benefits of Citibank Simplicity Credit Card

- The card does not charge the late repayment fee, cash advance fee or over-limit fee whatsoever.

- Avail of supplementary cards for your family without additional charges.

- Get a 50% discount on online food delivery via Zomato and various discounts on restaurant bills at over 500 food outlets across the UAE.

- Avail of easy installment plans to pay for the larger transactions.

- Get instant cash loans through online banking or Citibank Mobile app.

- Enjoy access to Citi World Privileges in over 95 countries worldwide.

RAKIslamic Gold Credit Card

.png)

-

Minimum Salary AED 5,000

-

Annual Fee Free for Life

- Balance Transfer

- Free for life

- Hotel Discount

- Travel accident & Purchase protection Takaful

Benefits of RAKIslamic Gold Credit Card

- Earn reward on each domestic and foreign currency expenditure.

- Avail of supplementary cards for your family without additional charges.

- Secure your purchased products with the purchase protection facility.

- Enjoy exclusive discounts and benefits on vacations, dining, furnishing, electronics and more.

- Avail of discounted rides of up to 20% on the first three Uber bookings in a month.

- Get up to 30% discount on dining bills at more than 2,000 restaurants across the UAE with RAKfoodie.

- The card has one of the highest grace periods of up to 55 days.

- Get a cash advance of up to 80% of your credit limit.

- Low minimum payment requirement of just 3% of the outstanding bill every month.

- Get attractive online shopping and dining discounts in the UAE.

- Enjoy discounts on premium brands and hotels bookings worldwide.

- Avail of 10% discount at rentalcars.com.

- Access various BUY 1 GET 1 offers.

- Enjoy up to 60% off at European Shopping Villages.

Emirates NBD Lulu Titanium Credit Card

Emirates NBD LuLu Titanium Credit Card

-

Minimum Salary AED 5,000

-

Annual Fee Free for Life

- Free for Life

- Airport Lounge Access

Benefits of Emirates NBD Lulu Titanium Credit Card

- Get quick access to major sales and promotions in the UAE.

- Enjoy free shipping on every online order.

- Get monthly discounts and offers on supermarket purchases.

- Enjoy free Amazon Prime Membership.

- Get access to various BUY 1 GET 1 offers across the UAE.

- Avail of unlimited airport lounge access through LoungeKey.

- Get attractive offers on Careem rides with a chauffeur.

- Get various offers and discounts on Lingokids.

- The card offers secure and contactless payment.

- You get a globally accepted credit card.

- Enjoy convenient utility bill payments through various online and offline channels.

- Enjoy exclusive discounts on travel and hotel bookings.

- Conveniently activate Auto Salik top-up facility.

- Earn Lulu points for each credit card expense in the UAE.

- Get Emirates NBD exclusive SkyShop store access.

- Avail of free balance transfer facilities for convenient finance management.

- Easy installment plans for repayment of expensive purchases.

RAKBANK Red Credit Card

-

Minimum Salary AED 8,000

-

Annual Fee Free for Life

- Free for Life

- Dining Discounts

- Special Discounts

Benefits of RAKBANK Red Credit Card

- Earn up to 1.5% cashback on every domestic and international expenditure.

- Avail of Credit Shield insurance to secure your outstanding payments.

- Enjoy a 0% easy payment plan to manage your bigger purchases.

- Avail of up to 20% discount on Uber rides for the first three bookings.

- Enjoy up to 30% discount across 2,000 restaurants in the UAE through RAKfoodie.

Emirates NBD U By Emaar Family Credit Card

-

Minimum Salary AED 5,000

-

Annual Fee Free for Life

- Receive AED300 noon.com voucher

- Free for Life

- Dining Discounts

- Movie Tickets

- Special Discounts

Benefits of Emirates NBD U By Emaar Family Credit Card

- Get quick access to major sales and promotions in the UAE.

- Enjoy free shipping on every online order.

- Get monthly discounts and offers on supermarket purchases.

- Enjoy free Amazon Prime Membership.

- Get access to various BUY 1 GET 1 offers across the UAE.

- Avail of unlimited airport lounge access through LoungeKey.

- Get attractive offers on Careem rides with a chauffeur.

- Get various offers and discounts on Lingokids.

- The card offers secure and contactless payment.

- You get a globally accepted credit card.

- Enjoy convenient utility bill payments through various online and offline channels.

- Enjoy exclusive discounts on travel and hotel bookings.

- Conveniently activate Auto Salik top-up facility.

- Earn Lulu points for each credit card expense in the UAE.

- Get Emirates NBD exclusive SkyShop store access.

- Avail of free balance transfer facilities for convenient finance management.

- Easy installment plans for repayment of expensive purchases.

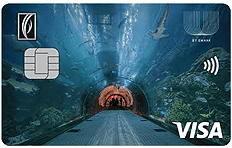

DIB Emirates Skywards Platinum Credit Card

-

Minimum Salary AED 5,000

-

Annual Fee AED 525

- Balance Transfer

- Golf Discounts

- Dining Discounts

- Roadside Assitance

Benefits of DIB Emirates Skywards Platinum Credit Card

- You can earn up to 5,000 Skywards Miles and redeem them to enjoy additional travel discounts.

- You earn 1 Mile on every USD equivalent spent for flight booking through Emirates.com, 0.75 Miles for foreign currency spends and 0.5 Miles on all local currency spending.

- Avail of 0% easy payment plans on ticket bookings through Emirates.com to any destination.

- Get exclusive access to over 900 premium hotels via Visa Luxury Hotel Collection.

- Avail of the balance transfer facility for convenient credit card bill management.

- The card offers complimentary medical and legal referrals for your travel convenience.

- Enjoy a 25% discount on Zomato food orders, including dining offers at various restaurants across the UAE.

- Get optional roadside assistance up to 3 times a year.

List of Top Credit Cards on 6000 Salary in UAE with Salary Requirement & Annual Fee

|

Credit Card Type |

Minimum Salary Requirement |

Annual Fee |

|---|---|---|

|

Citibank Simplicity Credit Card |

|

|

|

RAKIslamic Gold Credit Card |

|

|

|

Emirates NBD Lulu Titanium Credit Card |

|

|

|

RAKBANK Red Credit Card |

|

|

|

Emirates NBD U By Emaar Family Credit Card |

|

|

|

DIB Emirates Skywards Platinum Credit Card |

|

|

Eligibility Criteria to Apply for Credit Cards under AED 6,000 Salary in UAE

To obtain a credit card, applicants must satisfy various eligibility criteria pertaining to their age, salary requirements, etc. The requirements may vary depending on the bank and the type of credit card you choose. The general eligibility criteria for credit cards under AED 6,000 salary are as follows.

- Age - An individual applying for a credit card should be at least 21 years of age or above.

- Salary - The applicant should have a stable salary and more than the minimum salary requirement of their preferred credit card.

- Nationality - UAE nationals and individuals can apply for credit cards by producing their original documents and proofs. Expats need to verify their eligibility before credit card application since a few credit cards are not available to them.

| Know Your Credit Score |

Documents Required to Apply for a Credit Card Under AED 6,000 Salary in UAE

Individuals need to submit the required documents during credit card application for record and verification purpose. The documents that you need while applying for a credit card under AED 6,000 are-

- An original and copy of the passport for the expats

- An original and copy of Emirates ID for the UAE nationals and residents

- Latest three months bank account statements

- Salary slip not older than a month or a salary certificate issued by the current employer

- Utility bill or tenancy agreement for address proof

At a salary between AED 5,000 to 6,000, you have several credit card options in the UAE. However, you will get basic credit card services on a low salary requirement credit card. You need to search for a card that offers good services, ample rewards, and cashback. Also, the bank should levy low annual membership charges, retail interest rates and other fees.

To get your credit card queries resolved, you can always reach out to our support team, and they will provide you with the best possible resolution.

Related Links -

More From Credit Cards

- Recent Articles

- Popular Articles