How Annuity Plans Work in the UAE

Here's how an annuity plan typically works in the UAE —

800 800 001

Planning for retirement in the UAE? Annuity plans might be your smartest move yet. In a world where job-based pensions are rare, these plans offer guaranteed income even after your paychecks stop.

Whether you’re a UAE resident or an NRI living here, investing in an annuity plan can give you the peace of mind that your future finances are secure.

You’ll learn what annuity plans are, how they work, their key benefits, the types available in the UAE, and the top providers offering them. Let’s help you plan a financially worry-free retirement.

A retirement annuity plan is a financial product designed to provide a steady stream of income, usually after retirement. You invest a lump sum or pay in installments. In return, you receive regular payouts (monthly, quarterly, or annually) — either immediately or after a set period.

Key Features

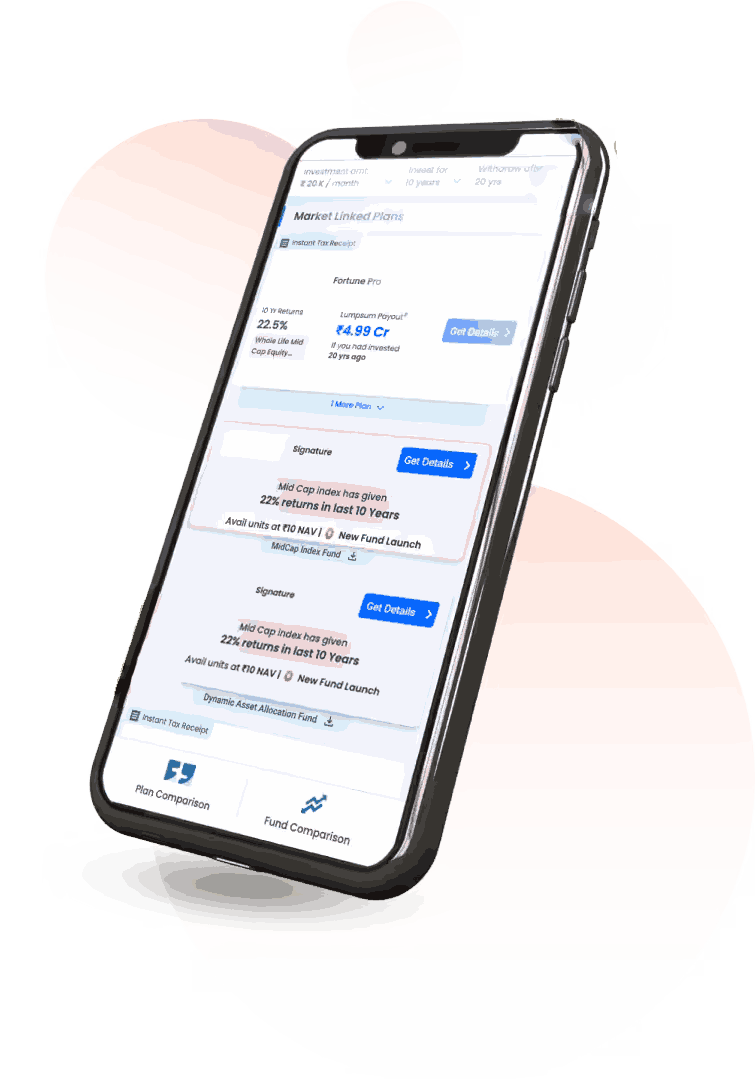

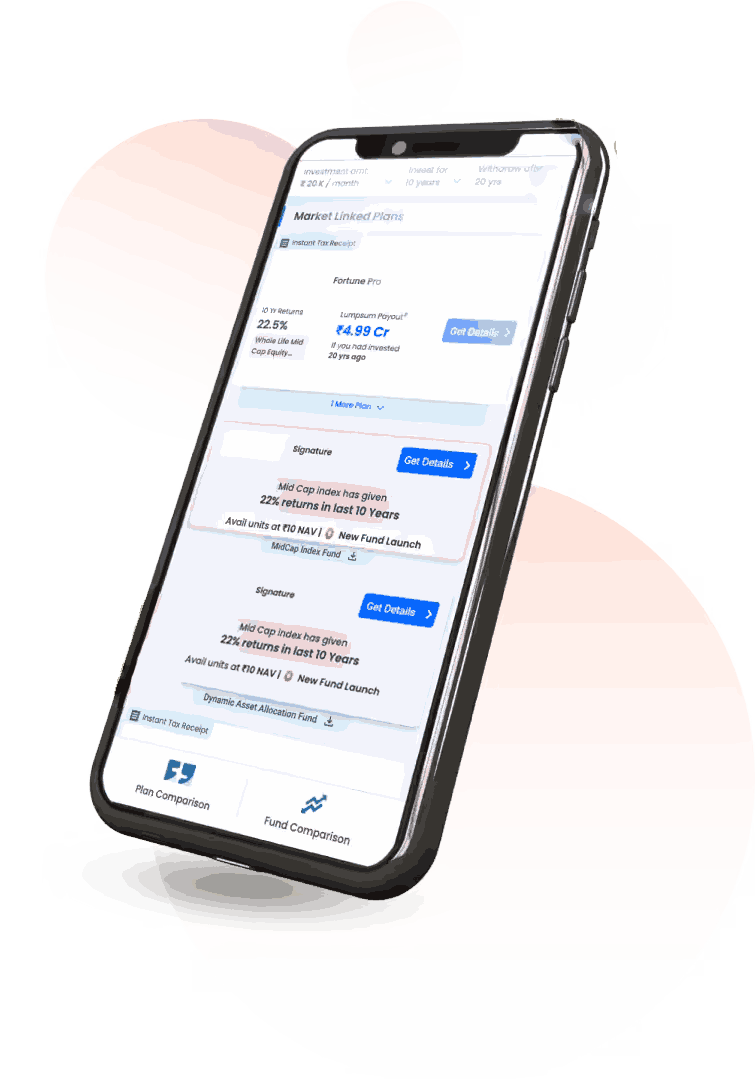

Some of the best Investment quotes in UAE & Dubai are:

Here's how an annuity plan typically works in the UAE —

This makes retirement annuity plans especially useful for retirement income, estate planning, and financial stability for dependents.

To help you choose a plan that fits your needs the best, let’s understand the types of annuities available —

| Annuity Plan Type | Description | Best For |

|---|---|---|

| Immediate Annuity Plans | You invest a lump sum and start receiving payouts almost immediately (usually within a month). | Retirees looking for instant income. |

| Deferred Annuity Plans | You invest now and allow the fund to grow over time. Payouts begin at a later date (say, after 5–10 years). | Young or mid-career individuals planning long-term retirement income. |

| Fixed Annuity Plans | These plans offer guaranteed payouts for a fixed duration, regardless of market performance. | Conservative investors who prefer stability over high returns. |

| Variable Annuity Plans | The returns and payouts depend on the performance of the underlying investments (e.g., mutual funds). | Investors willing to accept market risks for potentially higher returns. |

| Joint Life Annuity Plans | These policies cover two lives (e.g., husband and wife). Payments continue until both have passed away. | Married couples wanting lifelong financial security for both partners. |

| Annuity with Return of Purchase Price | After the annuitant’s death, the original investment is returned to the nominee. | Those who want to ensure capital protection for their heirs. |

No matter what happens in the market, you get a regular paycheck after retirement.

Choose monthly, quarterly, or annual income depending on your lifestyle needs.

Unlike mutual funds or stocks, annuities require minimal management once set up.

NRIs living in the UAE can invest in plans like LIC International or MetLife and secure retirement income in multiple currencies.

With return-of-purchase-price options, you can leave behind a financial cushion for your family.

Here's a comparison of some of the best annuity plans in the UAE —

| Provider | Plan Type | Key Benefits | Minimum Investment |

|---|---|---|---|

| LIC International | Deferred |

|

USD 5,000 |

| Zurich International | Retirement Builder |

|

- |

| MetLife UAE | Guaranteed Return and Shariah Compliant Plans | Flexible annuity options and legacy protection | Varies |

While the eligibility criteria vary slightly by provider, providers generally require the following—

Choosing the right annuity plan depends on your financial goals, retirement age, and risk tolerance. Ask yourself —

Compare fees, returns, payout flexibility, and the insurer’s reputation before you lock in a plan.

Tax Implications for NRIs and ExpatsAnnuity income, just like personal income, is generally not taxed in the UAE. However, if you are an NRI, you should check tax rules in your home countries (e.g., India taxes foreign income but allows some exemptions). Consult a financial advisor for clarity. |

|---|

Annuity plans in the UAE are a powerful instrument to ensure retirement doesn’t mean financial uncertainty. With guaranteed monthly income, minimal risk, and a wide choice of providers, they’re ideal for long-term financial planning, especially if you’re an NRI or expat looking to secure your future.

If you’re nearing retirement or planning ahead, now’s the time to explore the best annuity plans in the UAE that fit your lifestyle and goals.

Some plans have surrender options, although this option may involve charges or loss of benefits.

Yes, annuity income is taxable in India. However, you can reduce tax through DTAA provisions or exemptions.

Yes, annuity plans in the UAE are safe as they are regulated by the Central Bank and Insurance Authority, ensuring capital protection and reliable payouts.

First, estimate your future living expenses, healthcare needs, and desired income level. Next, use online annuity calculators or consult a financial advisor to determine the investment required.

No, annuity plans provide regular income, while retirement plans help you build a corpus. Annuity payouts can start as per your choice, while the retirement corpus is usually accessible post-retirement.