Credit Card in Dubai, UAE

Credit cards offer a convenient and flexible way to manage finances, make purchases, and enjoy exclusive perks. UAE banking institutions provide a wide variety of cards tailored to different lifestyles, whether you're looking for cashback, rewards points, or travel benefits. Many credit cards offer ...read more

- Buy one get one FREE at VOX Cinemas

- Unlimited free delivery : On talabat pro orders with a minimum order value of AED 50

- 5% cashback on groceries

- 1% cashback on all other retail purchases

- 5% cashback on groceries

- 1% cashback on all other retail purchases

- Enjoy automatic cash back on all purchases with Citi Cash Back Credit Card with no annual fee (subject to spend)

- Earn 3% on non-AED spend, 2% on grocery spend and 1% on all other spend

- No annual fee, late payment fee, cash advance fee or overlimit fee, ever

- Enjoy discounts on grocery, food delivery, as well as hundreds of Buy 1 Get 1 offers

- Earn up to 1.5 ThankYou® Points per USD spend

- Redeem points for cash back or travel-related spend at a click of a button from Citi Mobile® App

- 40% discount at over 100 golf courses worldwide

- Earn up to 1 Plus Points for every AED 100 spend

- Up to 3.5 % back as LuLu Points on daily spends

- Buy-one-get-on offer on VOX Cinema tickets

- 5% cashback when you shop and dine at the Emaar Hospitality Group

- Buy 1 get 1 free on movie tickets at Reel Cinemas and Free soft drinks and popcorn with every movie

- Up to 10% cash back on RTA transport payments, fuel spends

- Up to 2.25% cashback on international spends

Common Features & Benefits of Credit Cards

With UAE credit cards, you can enjoy the following benefits —

- Get exclusive discounts and offers on dining, shopping, leisure, lifestyle, travel, and more

- Pay in instalments on purchases in multiple categories

- Enjoy exceptional cashback on each transaction

- Make payments and earn reward points

- Easy cash withdrawals

Choose From a Range of Credit Cards

Tabled below are the key categorisations of credit cards in UAE —

| Credit Card Categories | Benefits Offered | Offers |

|---|---|---|

| Travel Credit Cards |

|

View Offers |

| Welcome Bonus Credit Cards |

|

View Offers |

| Balance Transfer Credit Cards |

|

View Offers |

| Cashback Credit Cards |

|

View Offers |

| Rewards Offers Credit Cards |

|

View Offers |

Important: This table is just a sneak peek — we offer many more categories of cards!

Check them out now on our credit card quotes page! Choose the best one as per your financial requirements.

Latest Credit Card Offers

As of September 2024, you can find our current offers with HSBC credit cards —

- HSBC Cash+ Card: Get Up to AED 600 Cashback*

- HSBC Max Rewards Card: Get AED 800 Cashback*

T&C Apply*

Can I Apply for a Credit Card via Policybazaar UAE?

Yes! On Policybazaar.ae, you can easily apply for a credit card in UAE. You can compare your options and get the best card with instant approval.

Here’s how to apply through our portal —

Why Should I Apply for Credit Cards via Policybazaar UAE?

Sign up today and unlock a world of benefits with Policybazaar.ae. We are a top insurance and banking aggregator in the UAE, with customer satisfaction being our top-most priority!

- Our collaboration with prominent UAE banks brings you a wide range of credit cards

- We offer you a unique platform to compare cards from different providers

- Our customer-centric approach ensures 24/7 expert assistance

- Free access to our website’s ‘Articles’ section for all credit card-related information

- Hassle-free and quick application process

- Apply and avail of exclusive credit card offers

Applying for a credit card - Policybazaar.ae vs Bank Websites

| Policybazaar.ae | UAE Banks |

|---|---|

| Find credit cards from the top UAE banks on a single platform | Bank-specific cards, i.e. limited options |

| Compare similar cards from different lending institutions — easy research | Need to compare cards from multiple bank websites, requiring extensive research |

| Exclusive rewards and welcome bonuses | Limited seasonal bonuses and rewards |

| Get a credit card with detailed customer reviews | Usually, customer reviews are not listed on bank websites |

| Use filters to view cards as per specific requirements | No options to apply filters |

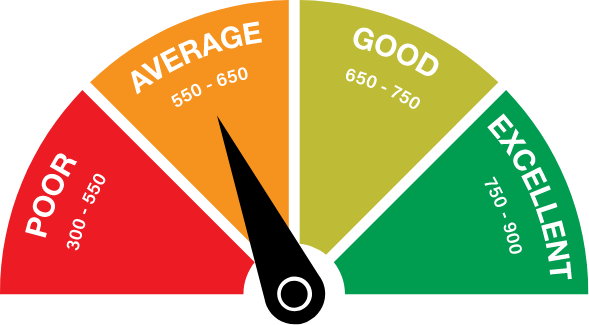

Can I Apply for Credit Card in UAE with a Low Credit Score?

Yes, you can apply, although getting a credit card with a low credit score in the UAE can be challenging. While it’s not impossible to get a card, a low credit score could limit the options available.

Your aecb credit score defines your creditworthiness. It represents your potential to manage finances and repay borrowed amounts to the bank within the given period.

Late payments, poorly managed loans, and multiple credit inquiries can significantly decrease your credit score. A low or poor score, in turn, can affect the approval of your credit card or loan applications.

So What’s the Alternative?

Secured credit cards, where a fixed deposit is held as collateral, may be offered if you have a low credit score. These cards can help you build your score while still offering access to credit facilities.

Improving your credit score by paying existing debts on time and keeping balances low can also enhance your chances. Know more on how to improve your credit score here!

Credit Card in UAE — Eligibility Criteria

Credit Card in UAE — Documents Checklist

Given below is a category-wise list of documents for credit card application verification in the UAE —

| For Salaried Individuals | For Self-Employed Individuals |

|---|---|

|

|

Note:

- All your documents must be valid and original.

- It’s recommended to keep a copy of each document handy.

- Your bank may ask for additional document(s).

Get the Best Credit Cards Quotes from Top Leading Banks in UAE

Fees & Charges of Credit Cards in UAE

Here are some of the major fees associated with UAE credit cards — let’s understand what they mean:

Annual Fee

Cash Advance Fee

Late Payment Fee

Balance Transfer Fee

Foreign Transaction Fee

Overlimit Fee

Card Replacement Fee

Sales Voucher Copy Fee

Card Statement Fee

The annual fee is a yearly charge levied by credit card issuers for using certain premium cards. This fee varies based on the card’s benefits — high-end cards offering rewards, travel perks, and bonuses often carry higher fees.

Some cards have waivers on the annual fee for the first year or for meeting spending requirements.

This fee is charged when you withdraw cash from an ATM using your card. This fee is usually a percentage of the amount withdrawn in addition to immediate interest charges. Cash advances often have higher interest rates compared to regular card purchases.

As the name suggests, this fee applies when you fail to make the minimum required payment within the due date. Repeated late payments can negatively impact your credit score and may result in higher interest rates being applied to the card balance.

This fee is imposed when you transfer outstanding debt from one credit card in UAE to another one that offers lower interest rates. While balance transfers can save on interest payments, you should carefully consider this fee, especially if the transferred amount is substantial.

This applies when you make purchases in a currency other than the UAE currency.

If you are a frequent international traveller, you can find certain cards that waive or minimise this fee to avoid extra charges.

When you exceed your assigned credit limit, an over-limit fee is levied. Banks generally allow overlimit spending for emergencies, but frequent overuse may lead to increased interest rates and negatively impact credit scores.

This fee is incurred when you request a new card due to loss, theft, or damage of the original card. Some banks waive this fee for premium cardholders or in certain circumstances, like stolen cards reported within a specific period.

It is charged when you request a physical copy of a transaction receipt. While many transactions can be verified through online statements, this fee may apply for disputes or proof of purchase when electronic records are insufficient.

A card statement fee is charged when you request a physical copy of your credit card statement. It is advisable to opt for digital statements as they are environment-friendly and free of cost.

New Credit Cardholder Advantages

New credit card holders in the UAE can enjoy a range of benefits.

Firstly, many cards offer welcome bonuses such as reward points, cashback, or free air miles that provide immediate value. Some also provide easy access to instalment plans for major purchases, allowing you to spread payments over time without high interest.

Additionally, many UAE banks offer perks like free travel insurance, extended warranties, and access to exclusive airport lounges, enhancing travel experiences. Discounts on dining, shopping, and entertainment, along with the ability to earn loyalty rewards further add to the card's value.

Lastly, a credit card helps you build a good credit history. This is highly important for future financial applications like loans and other cards.

Know These Points Before Applying for a Credit Card in UAE!

What is a Credit Card Statement?

It is a detailed monthly report issued by your bank. This statement enlists all your transactions made during the billing period.

This report includes information such as purchases, payments, fees, interest charges, and the minimum payment due. It also highlights the total balance, available credit, and payment due date.

By regularly reviewing credit card statements, you can track spending, identify errors, and manage finances efficiently. You can choose paper or electronic statements. While the latter is more environment-friendly and free, paper statements may have a small fee.

What are the Applicable Card Fees and Charges?

Certain fees and charges are associated with a credit card. These include annual fees, interest rates, late payment fees, cash advance fees, foreign transaction fees, and more. These fees vary as per the card type, issuer, and cardholder’s usage.

Understanding these charges is essential for avoiding unnecessary costs. You must review terms and conditions carefully to stay updated with the fees that may apply based on your card activity.

Can I Withdraw Cash Using My Credit Card?

Yes, you can! Withdrawing cash through a credit card, known as a cash advance, allows you to access cash from ATMs. However, note that fees and interest rates are applied on cash advances.

Banks charge a percentage of the withdrawal amount and apply immediate interest on the cash. These rates, in fact, are often higher than standard card purchases.

This service is helpful for emergencies but is generally considered expensive. So it’s advisable to limit cash withdrawals via these cards unless necessary.

What are Reward Points?

Reward points are loyalty incentives offered by credit cards. These points are earned on card purchases. You can redeem them for various benefits such as flights, hotel stays, shopping vouchers, or exclusive experiences.

Different cards offer different reward structures, with some focusing on travel, retail, or lifestyle categories. Accumulating reward points is ideal for those who regularly use their cards for purchases and want to enjoy discounts and perks.

What is My Bill Payment Cycle?

A credit card bill payment cycle refers to the period between two consecutive statement dates, usually lasting 30 days. During this period, you make purchases — at the end of the cycle, a statement is generated showing the total amount owed.

A grace period is given to pay off the balance before incurring interest charges. Paying the full balance within the cycle helps avoid interest, while only paying the minimum will result in accumulating debt.

Do’s & Don’t of Credit Cards

We have explained the major do’s and don’ts of credit cards in the table below —

| What to Do? | What Not to Do? |

|---|---|

|

Explore Credit Card Options Before applying, thoroughly explore different options to find one that suits your lifestyle and financial needs. Compare features like interest rates, rewards programs, annual fees, and special benefits. UAE banks offer various cards tailored for travel, shopping, or cashback. Comprehensive research ensures that you maximise card benefits and avoid cards with hidden fees. |

Exceeding Your Credit Limit Make sure you don’t exceed your credit limit — this can bring overlimit fees and impact your credit score. Exceeding your card limit can also lead to higher interest rates. Banks usually offer credit alerts or notifications when you’re approaching your limit. Keep track of such alerts to manage your spending and avoid additional charges. |

|

Read the Terms and Conditions Always read the terms and conditions before applying for or using a credit card. These details outline important elements like interest rates, fees, rewards policies, and repayment terms. UAE banks have varied fee structures — understanding these terms can help you avoid unexpected charges, penalties, or unfavourable interest rates that can negatively impact your finances. |

Paying the Minimum Amount Due is a Big No Paying only the minimum due amount on your card will accumulate interest on the remaining balance. This can lead to significant debt over time. It’s advisable to pay your bill in full each month to avoid high interest rates and keep your finances under control. Clearing your full balance ensures you don’t fall into a debt cycle and maintain a healthy credit score. |

|

Stay Updated with Your Bill Date Make sure you stay updated with your credit card’s bill date to avoid late payments, which may result in penalties and interest charges. Banks keep sending reminders via SMS or email, helping you keep track of payment deadlines. Timely payments keep your credit score healthy and save you from late fees. You may consider setting up automatic payments to manage bills efficiently. |

Applying for Multiple Credit Cards at a Time Applying for multiple cards within a short span can negatively impact your credit score. Each application results in a hard inquiry on your credit report, lowering your score. Having too many cards can also lead to overspending, difficulty in managing payments, and increased fees, making it challenging to stay financially organised. |

|

Track Your Expenses Track your expenses regularly to avoid overspending on your credit card. By monitoring purchases, you can stay within your credit limit and manage your monthly payments better. Keeping an eye on expenses also helps identify fraudulent activity. Most banks and financial institutions provide easy online tools and mobile apps for tracking spending. |

Making Restricted Transactions Credit cards in UAE have restrictions on certain types of transactions such as gambling or purchasing prohibited items. Engaging in restricted transactions can result in penalties, account suspension, or even legal consequences. Always check your bank’s guidelines on prohibited purchases and use your card only for legitimate, approved transactions to avoid these risks. |

Pro Tips for Securing Credit Card Usage

Take these points into account when using your offline and online credit card —

- Keep changing your 4-digit PIN within a regular interval.

- Never share your card PIN with anyone as it can lead to misuse of your card.

- Always avoid using your card on suspicious websites as they may be fake.

- Stay updated with your transactions to keep track of any fraudulent or unauthorised transactions.

- Report your stolen card immediately to avoid any transactions.

UAE Credit Card Reward Points: How to Use Them?

Reward points are fundamentally loyalty points earned through spending on a credit card. For each eligible spend, you accumulate points. These can be further used for redemption.

Different cards offer different types of rewards, including travel miles, cashback, hotel stays, or shopping vouchers.

Using reward points is a straightforward process. After accumulating a certain number of points, you can redeem them through the bank’s online portal or app. Many UAE credit cards are linked with airline programs, such as Emirates Skywards or Etihad Guest. This allows you to convert points into air miles for free flights or upgrades.

Points can also be used for discounts at partner merchants, including restaurants, hotels, and shopping outlets.

Additionally, some reward points can also be exchanged for cashback. These are credited to your account to reduce outstanding balances. Understanding your card's specific rewards program helps you maximise the benefits and ensures you're getting the most value from your spending.

Read More About Salary Based Credit Cards

FAQs About Credit Card in UAE

Ans: There is no specific bank offering the best credit card — you will need to choose the one that fulfils your financial requirements. Nevertheless, some of the top banks for the same include Emirates NBD, FAB, HSBC, ADCB, CBD, Emirates Islamic Bank, and more.

Ans: Head out to Policybazaar.ae and get your ideal credit card in just a few steps.

Ans: Unfortunately, you are not eligible to apply for a credit card if you have a salary below AED 5,000.

Ans: Yes, you can get a credit card in the UAE. Several banks offer cards for expats.

Ans: You can get any UAE credit card provided you comply with that specific card’s eligibility.

Ans: You must have a minimum monthly salary of AED 5,000 to be eligible for an NBD credit card in the UAE.

Ans: Housewives can’t usually apply for a primary credit card. However, they are eligible for holding a supplementary card.

Ans: Banks usually ask for 3-6 months’ salary slips.

More From Credit Cards

- Recent Articles

- Popular Articles