Salary Slip: Download Format, Components & Importance in UAE

Personal Loan up to 8 times your Salary

- Minimum Salary 5000 AED

- EMI Tenure up to 48 Months

- Lowest Interest Rates

Get personal loan at Lowest Interest Rate

What Is a Salary Slip?

A payslip or a salary slip is an important document containing a detailed list about the various components of your salary along with specific details of employment. Whether this document is sent as a hardcopy or as an e-payslip via online modes, all employees, irrespective of their working hours or contracts has the right to a salary slip. This document allows the employees to see their monthly salary and their gross pay, as well as other personal details.

When the employers handle salary slips or payslips and during the process for the same, it is important for them to take sufficient time to make sure that the payslips of the employees remain confidential to them.

Why Is Understanding Salary Slip Important?

The salary slip of an employee is quite important as it acts as legal proof of his or her earning and deductions. That is why as per the law; you have the right to ask for your payslip if your company does not provide it to you.

Furthermore, a payslip is an essential document if you are an individual who is seeking to apply for a personal loan, credit cards, home mortgages, etc. It is also important for receiving any of the applicable government benefits such as medical benefits or subsidy.

What Is the Need of Salary Slip To Apply For Personal Loan?

Personal loan in UAE is not bound by a salary slip or a payslip. However, all the lenders out there in the market will require you to submit some proof of your income. Personal loans are offered to both salaried individuals and self-employed applicants. If you mention ‘salaried’ on your application form, it can be compulsory for you to submit a salary slip. On the other hand, self-employed individuals are not required to submit a payslip. There is also a minimum salary requirement for many banks to apply for a personal loan. Even you can also apply for a personal loan in UAE with 3000 salary online.

The payslip becomes a compulsory document when applying for a personal loan based on just your profession. Therefore, being a salaried individual you will be required to present a salary slip as proof of your income.

Check Your Personal Loan EMIs Through Personal Loan EMI Calculator

Who Gets a Salary Slip?

Workers are employed in the UAE in return for a wage that is either annual or monthly. They are obliged to receive their salaries on a monthly basis on the due date and no later than a period of 10 days after the salary period is over. If there is no such period that is stated in the contract, the employer must pay the workers once every fourteen days. The payment must be in UAE’s national currency and must be conducted on weekdays only.

The employees that receive a salary, irrespective of their working hours or their employment contacts have the right to obtain a salary slip or a payslip in UAE.

How to Apply for a Salary Slip?

Each business has a different process for their payroll and the pay slip format that they use. This depends on various factors such as the size of the business and the roles that the business offers – be it temporary, part-time, or full-time workers.

The smaller business and the startups are likely to move along by running payroll using spreadsheets and producing the payslips or salary slips of their employees manually. Whereas, the businesses that are growing or already grown generally use payroll software that replaces the manual work and sends the payslips to the employees virtually i.e., an e-payslip.

Payslip Format or Salary Slip Format

Although salary slips can be laid out in various different ways using the kinds of payslip template, there are some components that should be included:

- Gross Pay: This is the amount that is supposed to be paid to you initially. In the case of employment in the UAE, this may be your final pay.

- Net Pay: If you are residing elsewhere, and are required to pay a tax, you will be able to spot your net pay i.e., the amount that you are supposed to receive after the deduction for tax is made.

- Payroll Number: Every worker is allotted a payroll number that is unique. It is often generated by the payroll software of your respective company.

- Tax Code: If you are entitled to pay any type of taxes for whatsoever reasons, you are given a tax code that is unique. This code determines the amount that is deducted every payday.

- Sick Pay and Other Kinds of Leaves: Sick pay along with any maternity or paternity leave may be separately itemized on your salary slip.

- Pension Contribution: In UAE, employers are required to hold back 5% of the local employees’ salaries in the form of a pension contribution. However, this does not apply to foreign workers.

- Other Benefits: Any sort of bonus, company perks (for example health insurance or life insurance), or overtime benefits may be itemized on the salary slip.

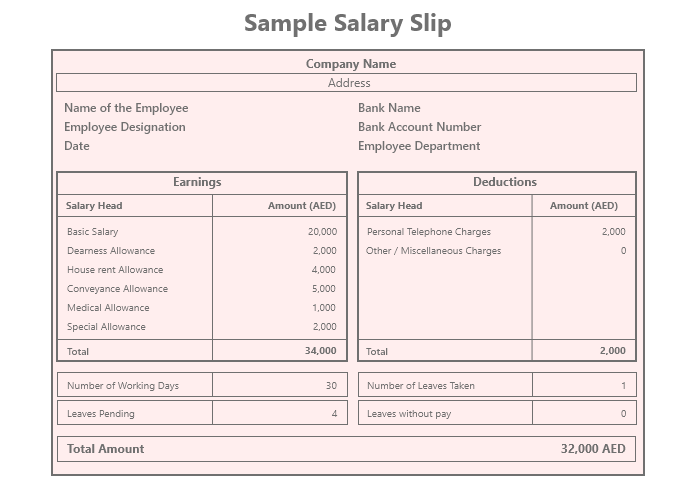

To give you a clearer picture of the components, we’ve shared an EMT’s Payslip with you here. You can go through the sample EMT payslip to develop a better understanding of salary slips and their general inclusions in the UAE. Take a look here:

The Salary Deductions on the Salary Slip

There are numerous types of deductions that need to be made from the salaries of the employees. There could be leaves taken by the employees that need to be accounted for or any sorts of violations or fines that need to be adjusted in their salaries.

Employers in UAE are also required to hold back the contribution for pensions for the local workers. The foreign works neither contribute to nor receive any pension funds. The local employees are required to contribute 5% of their salary or wage as a pension, while the employers are required to contribute 12.5%.

Types of Payslips

The salary slip type varies from one company to another. However, the employer can either manually generate the salary slips for the employees (generally in case of smaller businesses) or they might have payroll software that generates the payslips for the workers.

This document can either be a hardcopy or an e-payslip depending on your employer.

Manual salary slips have quite a purpose and are considered original payslips along with being a receipt of payments. Whereas, the most essential purpose of an e-salary slip is that it can be stored properly and can be used at any given point of time in the future.

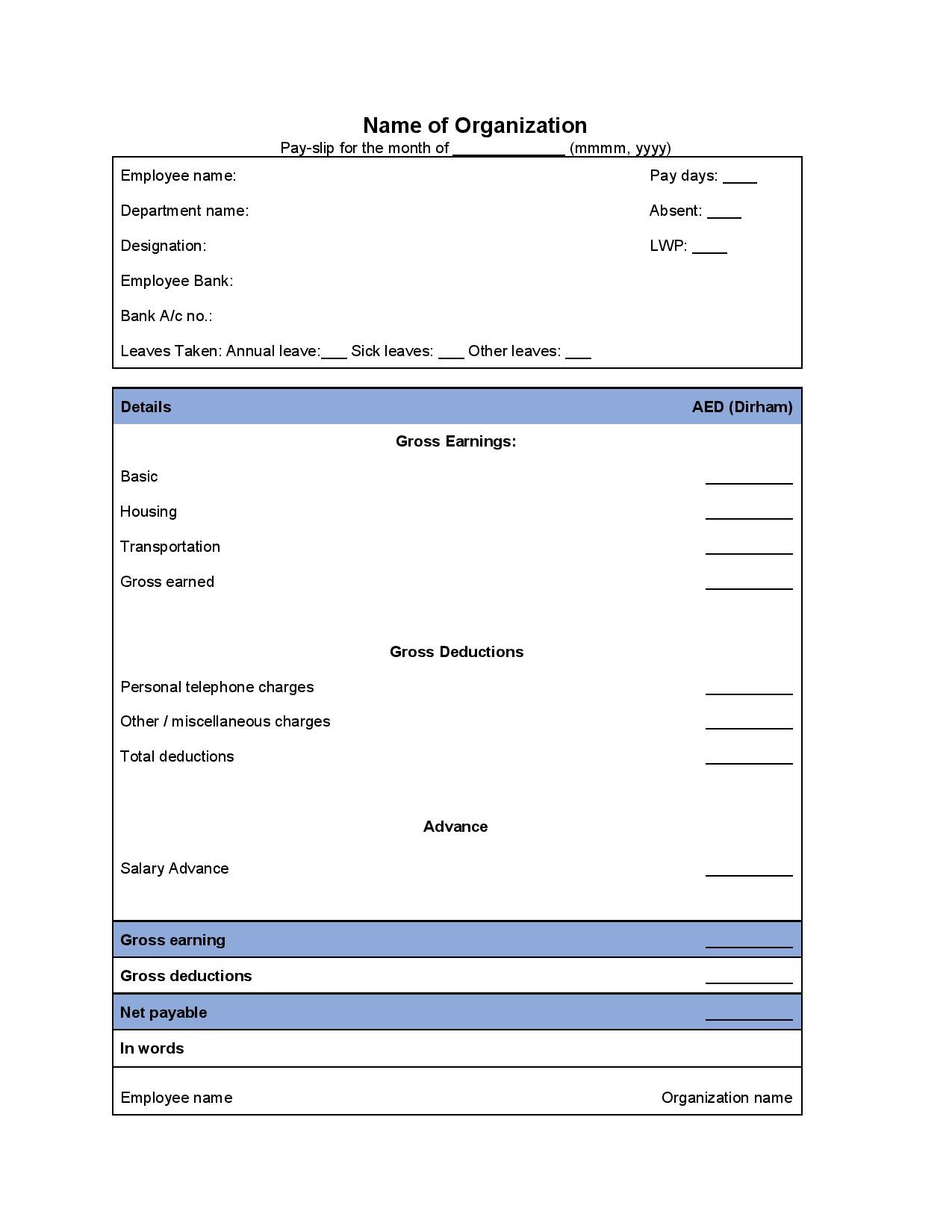

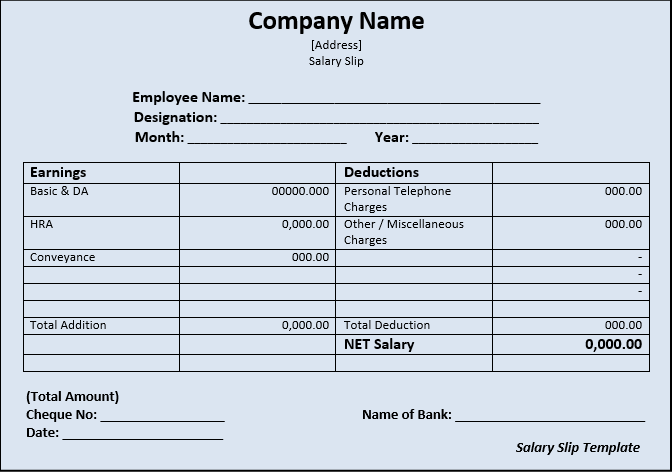

Pay Slip Format or Sample

The salary slip format may vary across different employers. Generally, it looks like:

Download Salary Slip Format in Word

Download Salary Slip Format in Word

Legal Validity of Manual & Digital Payslips

A salary slip in manual form or digital form holds the same legal status. However, any sort of tampering or alteration with a payslip is considered a criminal offense.

What Are the Benefits of a Salary Slip?

- Figuring out your pension fund savings: With the help of your salary slip, you can calculate the actual amount of the employee and employer pension fund contribution.

- Background checks: Payslips act as an important document when it comes to conducting a background check when you are switching jobs or applying for further studies. The employers and admission teams seek payslips in order to validate the claims you have made related to your salary. In case you are opting for a job change, your hike will be dependent on the salary figure and the structure of the same.

- Obtaining loans from banks: When the banks or financial institutions are determining your repayment potential for the loan your salary slip plays a major role. It also comes into consideration while deciding your loan amount.

How Is Cost to Company (CTC) Different from In-hand/Gross Salary?

Cost to company or CTC is the total amount that the company will incur on the employee, in one year. Whereas, the gross salary is an amount that is received by the employee in the form of a salary, prior to accounting for any deductions. The CTC involves salary, contributions, and reimbursements.

Gross salary, on the other hand, is the amount that is committed to being paid by the employer to an employee on a monthly basis. It does not account for contributions to the pension funds, among other things.

Components such as the basic pay, house rent allowance, city compensatory allowance, and other allowances form a part of your gross salary.

How is a Salary Certificate Different from a Salary Slip?

- As the name suggests, a salary certificate is a signed document that is printed on the letterhead of the company and contains a stamp of authority. It is used to certify that a person was working with a company for a given period in return for a fixed salary.

- A salary certificate is not the same as a salary slip or a payslip. The salary certificate does not have to show the detailed structural breakup of the individual’s salary. On the other hand, a salary slip is a document that gives the complete details of the income of the employee along with any deductions that have been accounted for in the monthly salary.

The salary certificate is a proper proof of one’s employment and it does not have to indicate the financial standing of the individual. Whereas, the salary slip is a document that assures the proof of one’s employment along with also giving a detailed picture of the employee’s financial standing.

Personal Loan Categories

Personal Loan Bank Wise

More From Personal Loans

- Recent Articles

- Popular Articles