Standard Chartered Bank (SCB) Reward Points Credit Cards in UAE

Standard Chartered Bank is one of the best-performing banks across the globe. The bank offers financial solutions such as bank accounts, fixed deposits, credit cards, loans, mortgages, and more for individual and corporate customers.

Standard Chartered Bank Credit Cards offer various exciting deals and discounts on dining, travel, entertainment, lifestyle and more for the cardmembers. The credit cards offer attractive reward points offers to help cardmembers earn even from their expenditures.

Let us go ahead and know about the Standard Chartered Bank Reward Points Credit Cards in detail.

Best Standard Chartered Bank Reward Points Credit Cards in UAE

Here are the types of Standard Chartered Bank Credit Cards that offer exclusive reward point deals for cardmembers.

Standard Chartered Visa Infinite Credit Card

Visa Infinite Credit Card is one of the best reward points credit cards offered by Standard Chartered Bank. The credit card comes with a minimum monthly salary requirement of AED 30,000 for the applicants. The best part is that the card members do not need to pay any annual membership fee to keep this card active for the entire first year. However, they need to pay AED 1,575 from the second year onwards.

-

Minimum Salary AED 30,000

-

Annual Fee AED 1,575

- Free for 1st year

- Airport Lounge Access

- Golf Benefits

- Health Club Memberships

- Rewards Offers

Reward Points Benefits for Standard Chartered Visa Infinite Credit Card

- Reward Points: Standard Chartered Visa Infinite Credit Card members can earn an attractive amount of reward points by simply spending on local and international stores.

- Points-to-Miles: Standard Chartered Visa Infinite Credit Card members can convert their earned reward points into Emirates Skywards Miles and Etihad Guest Miles. Moreover, they can also redeem these points to be a part of hotel loyalty programmes.

- Cashback Offers: Standard Chartered Visa Infinite Credit Card members can convert up to 2 percent of their earned reward points into cash back and use the same to book flight tickets with any airlines company.

- Purchase with Rewards: Standard Chartered Visa Infinite Credit Card members can also use these earned reward points to make purchases on more than 20 million online and offline stores anywhere in the world.

Features & Benefits for Standard Chartered Visa Infinite Credit Card

- Supplementary Cards: Standard Chartered Visa Infinite Credit Card members can get the first two supplementary cards free for their family members. The offer is valid for the first year from the card registration date. The cardholders need to pay AED 525 to avail of this benefit from the second year onwards.

- Airport Transfers: Standard Chartered Visa Infinite Credit Card members get four free Careem airport transfers per year when using this credit card for bookings. The cost for these rides is capped up to a maximum of AED 100 per ride. The promo code to avail of this benefit is UAEVI.

- Golf Offers: Standard Chartered Visa Infinite Credit Card members get a free round of golf every month at the various high-standard golf clubs in the UAE.

- Access to Airport Lounges: Standard Chartered Visa Infinite Credit Card members get priority access to over 1,000 airport lounges around the world. The best part is that the cardholders can enjoy these benefits with one guest.

- Medical and Travel Insurance: The credit card comes with a multi-trip travel insurance policy for the cardholders. With this insurance plan, the cardmembers can get coverage against loss, damage or bodily injuries caused to the cardholders or their families while traveling. The insurance covers trips of up to 90 days in duration.

- Fitness First Access: Standard Chartered Visa Infinite Credit Card members enjoy free access to popular Fitness First clubs in the UAE.

- Visa Concierge Service: With a Visa Infinite Credit Card of Standard Chartered Bank, cardmembers can enjoy last-minute reservations even on a special occasion. The service enables cardmembers to get full-time priority personalised services. All they need to do is use this credit card for their bookings.

- Movie Offers: Standard Chartered Visa Infinite Credit Card offers attractive deals and discounts on movie tickets to VOX Cinemas. The offers include free movie tickets with an exciting buy 1 get 1 offer at Costa Coffee.

- Cash in Advance: With a Standard Chartered Visa Infinite Credit Card, the cardmembers can easily withdraw cash in advance when in need of funds. They need to go to one of the bank’s ATMs and withdraw cash based on their financial needs.

- Credit Shield Insurance: The Standard Chartered Visa Infinite Credit Card members get a credit shield insurance service that provides coverage against the outstanding credit card balance in the event of total/permanent disability. The insurance company also clears out the cardholder’s debts in case of their death.

- Buyers Protection: The credit card members also get buyers protection benefits against loss or damage caused to the covered products purchased using their Visa Infinite Credit Card.

- Mobile Wallet Payments: With Standard Chartered Visa Infinite Credit Card, the cardmembers get multiple payment options such as Apple Pay, Samsung Pay, Google Pay, Fitbit Pay, and more to make payments easily.

- Online Banking Services: Standard Chartered Bank offers online banking services to help cardholders access their credit card details in just a few clicks. With this facility, they can keep close track of all their transactions and manage their credit card anytime, from anywhere.

- Mobile Banking Services: The bank also offers mobile banking services for cardmembers to have all the banking services right at their fingertips. They can simply download the Standard Chartered Mobile Banking App from their preferred app store and start using these services with great ease.

- Careem Offers: Standard Chartered Visa Infinite Credit Card offers attractive deals and offers on Careem rides. The cardmembers can get a 20 percent discount on the first three Careem rides. They also get 50 percent off on three Careem Food & Shop orders every month. To avail of all these offers, the cardmembers need to use the Visa Infinite Credit Card for making payments.

Standard Chartered Manhattan Rewards+ Credit Card

Standard Chartered Manhattan Rewards+ Credit Card is another amazing Reward Points Credit Card offered by the bank. The credit card comes with excellent reward points offers on online transactions on various retail stores and websites. The best part about this credit card is that it enables cardmembers to convert their earned reward points into miles and experience convenient and cheaper travel.

-

Minimum Salary AED 10,000

-

Annual Fee AED 525

- Free for 1st year

- Airport Lounge Access

- Hotel Discounts

Reward Points Benefits for Standard Chartered Manhattan Rewards+ Credit Card

- Reward Points: Standard Chartered Manhattan Rewards+ Credit Card enables cardmembers to earn 360-degree reward points for every USD spent while making local and international transactions.

- Points-to-Miles: Standard Chartered Manhattan Rewards+ Credit Card members can convert their earned reward points into Emirates Skywards Miles and Etihad Guest Miles. Moreover, they can also redeem these points to be a part of hotel loyalty programmes.

- Purchase with Rewards: Standard Chartered Manhattan Rewards+ Credit Card members can also use these earned reward points to make purchases on more than 20 million online and offline stores throughout the world.

Features and Benefits for Standard Chartered Manhattan Rewards+ Credit Card

- Annual Membership Fee: Standard Chartered Manhattan Rewards+ Credit Card members do not need to pay any annual membership fee for using the credit card for the first year. However, they need to pay AED 157 from the second year onwards.

- Supplementary Cards: Standard Chartered Manhattan Rewards+ Credit Card members can get the first two supplementary cards free for their family members. The offer is valid for the first year from the card registration date. The cardholders need to pay AED 157.50 from the third card onwards.

- Online Banking Services: Standard Chartered Bank offers online banking services to help cardholders access their credit card details in just a few clicks. With this facility, they can keep close track of all their transactions and manage their Standard Chartered Manhattan Rewards+ Credit Card anytime, from anywhere.

- Mobile Banking Services: The bank also offers mobile banking services for cardmembers to have all the banking services right at their fingertips. They can simply download the Standard Chartered Mobile Banking App from their preferred app store and start using these services with great ease.

- Access to Airport Lounges: Standard Chartered Manhattan Rewards+ Credit Card members get easy access to over 1,000 airport lounges in more than 300 cities around the world. The best part is that the cardholders can enjoy free eight visits per year.

- Movie Offers: Standard Chartered Manhattan Rewards+ Credit Card offers attractive deals and discounts on movie tickets to VOX Cinemas. The offers include free movie tickets with an exciting buy 1 get 1 offer at Costa Coffee.

- Airlines and Hotel Offers: Standard Chartered Manhattan Rewards+ Credit Card offers easy access to more than 10,000 hotels and 40 airlines across the globe. The cardholders can also get room upgrades and convenient flight upgrades by using this credit card to make bookings.

- Mobile Wallet Payments: Standard Chartered Manhattan Rewards+ Credit Card enables cardmembers to make hassle-free single-tap mobile wallet payments using Google Pay, Samsung Pay, and Fitbit Pay.

- Finance Charges: Standard Chartered Manhattan Rewards+ Credit Card applies monthly finance charges of 3.45 percent on retail transactions.

- Buyers Protection: Standard Chartered Manhattan Rewards+ Credit Card offers buyer’s protection against loss or damage caused to goods purchased using this credit card within a specific duration after the purchase.

- Medical and Travel Insurance: Standard Chartered Manhattan Rewards+ Credit Card offers medical and travel insurance benefits valid for trips of up to 90 days.

- Cinema Offers: Standard Chartered Manhattan Rewards+ Credit Card offers attractive buy 1 get 1 offer on movie tickets at VOX Cinemas. Additionally, the cardmembers can get 50 percent off on alternate medium popcorn when booked tickets using this credit card.

- VIP Guest Status: Standard Chartered Manhattan Rewards+ Credit Card enables cardmembers to enjoy VIP Guest Status at over 900 Luxury hotel collection properties worldwide.

- Visa Concierge Services: Standard Chartered Manhattan Rewards+ Credit Card offers full-time available Visa Concierge services to help cardmembers make easy and quick restaurant reservations.

- Airport Assistance: With Standard Chartered Manhattan Rewards+ Credit Card, the cardmembers can get an attractive 25 percent off on airport assistance at YQ’s. They can use their card for flight bookings and get facilities like customs and immigration clearance services, visa on arrival services, limo transfers, and more at over 450 destinations.

- Costa Coffee Offers: Standard Chartered Manhattan Rewards+ Credit Card offers exciting buy 1 get 1 offer at Costa Coffee outlets in the UAE.

- Dining Offers: Standard Chartered Manhattan Rewards+ Credit Card offers an exclusive 20 percent discount at over 200 airport restaurants across the globe using DragonPass.

Standard Chartered Saadiq Platinum Ujrah Credit Card

Standard Chartered Saadiq Platinum Ujrah Credit Card is free for the first year. The cardmembers need to pay an annual membership fee of AED 315 from the second year onwards to keep using this credit card. The credit card offers exciting reward points benefits on local and international purchases.

.jpg)

-

Minimum Salary AED 5,000

-

Annual Fee AED 315

- Airport Lounge Access

- Travel Discounts

- Hotel Offers

- Free for 1st Year

- Purchase Protection

Reward Points Benefits for Standard Chartered Saadiq Platinum Ujrah Credit Card

- Reward Points: Standard Chartered Saadiq Platinum Ujrah Credit Card members can earn an attractive amount of reward points by simply spending on local and international stores.

- 360-Degree Reward Points: Standard Chartered Saadiq Platinum Ujrah Credit Card members can earn reward points on local and international spending. Additionally, they can earn 360-degree reward points on every USD 1 spent on groceries, education, utilities, property rentals & more.

Features & Benefits for Standard Chartered Saadiq Platinum Ujrah Credit Card

- Supplementary Cards: Standard Chartered Saadiq Platinum Ujrah Credit Card offers four supplementary cards for free. The card members need to pay AED 157.50 from the fifth card onwards.

- Shariah-Compliant: Standard Chartered Saadiq Platinum Ujrah Credit Card is a Shariah-compliant card that follows Islamic Law and Principles.

- Travel Offers: Standard Chartered Saadiq Platinum Ujrah Credit Card offers an attractive 30 percent off on hotel and flight bookings with Cleartrip.

- Careem Rides Offers: Standard Chartered Saadiq Platinum Ujrah Credit Card offers 20 percent off on Careem rides booked every month using this credit card. With this card, the cardmembers can also get their first Careem ride for free.

- Coffee Offers: Standard Chartered Saadiq Platinum Ujrah Credit Card offers exclusive buy 1 get 1 free coffee offer at Costa Coffee.

- Expedia.Com Offers: Standard Chartered Saadiq Platinum Ujrah Credit Card offers a discount of USD 50 on flights and hotel bookings for cardholders spending a minimum of USD 1200.

- Airport Lounge Access: Standard Chartered Saadiq Platinum Ujrah Credit Card offers free unlimited access at more than 10 airport lounges in the Levant and Middle East region.

- Cash in Advance: Standard Chartered Saadiq Platinum Ujrah Credit Card enables cardmembers to withdraw funds from their credit cards as and when required. They can withdraw this cash from any ATM with the MasterCard logo worldwide.

- Easy Instalment Plans: Standard Chartered Saadiq Platinum Ujrah Credit Card enables cardmembers to convert their purchases of AED 1000 or above into six easy monthly installments at a zero percent interest rate.

- Mobile Payments: Standard Chartered Saadiq Platinum Ujrah Credit Card enables cardmembers to make convenient and quick mobile payments using wallets like Samsung Pay, Apple Pay, and more.

- Secure Online Purchases: Standard Chartered Saadiq Platinum Ujrah Credit Card offers a 3D Secure TM service powered by Visa for cardmembers to help them make easy and safe online payments.

- SC MasterPass: Standard Chartered Saadiq Platinum Ujrah Credit Card offers a digital wallet called SC MasterPass, which helps cardholders to store their payments and shipping details.

- Purchase Protection: With Standard Chartered Saadiq Platinum Ujrah Credit Card, the cardmembers can get purchase protection against the loss or damage caused to goods purchased using this credit card for up to 90 days.

- Other Benefits: Standard Chartered Saadiq Platinum Ujrah Credit Card offers various other exciting offers on dining, entertainment, travel, lifestyle and much more.

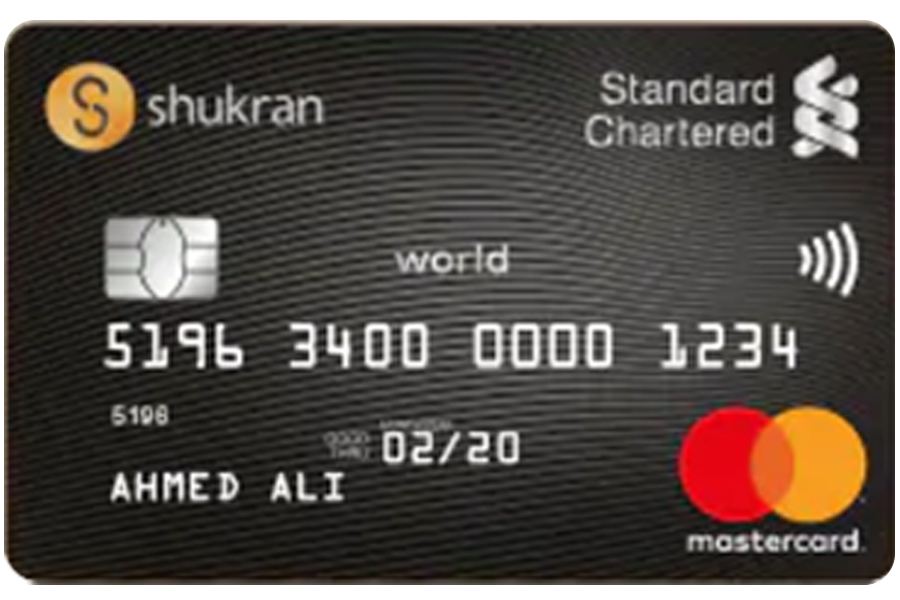

Standard Chartered Shukran World Credit Card

Standard Chartered Shukran World Credit Card is one of the best reward points credit cards in the UAE. The credit card offers exciting deals and discounts with various other benefits like travel insurance, MasterCard offers, and more.

-

Minimum Salary AED 25,000

-

Annual Fee AED 263

- Airport Lounge Access

- Travel Discounts

- Cinema Offers

- Travel insurance

Reward Points Benefits for Standard Chartered Shukran World Credit Card

- Shukran Reward Points: Standard Chartered Shukran World Credit Card enables cardmembers to earn five times more Shukran Reward Points at some selective establishments.

- Local and International Purchases: Standard Chartered Shukran World Credit Card members can earn Shukran Reward Points up to 1 percent of the purchasing value on local and 1.25 percent of the purchasing value on international purchases.

- Merchant Establishments: Standard Chartered Shukran World Credit Card members can earn up to 10 percent of purchases at some selective merchant establishments. They need to spend a minimum of AED 25,000 per month to avail this offer.

- Minimum Spend Requirement: The cardmembers need to spend a minimum of AED 3,000 per month to earn Shukran Reward Points.

- Redeem Shukran Reward Points: Standard Chartered Shukran World Credit Card members can redeem Shukran Reward Points instantly and buy millions of retail products.

Features & Benefits for Standard Chartered Shukran World Credit Card

- Supplementary Cards: Standard Chartered Shukran World Credit Card offers two supplementary cards for free. The cardmembers need to pay AED 100 from the third card onwards.

- Travel Offers: Standard Chartered Shukran World Credit Card offers an attractive 30 percent off on hotel and flight bookings with Cleartrip.

- Airport Lounge Access: Standard Chartered Shukran World Credit Card offers unlimited access at more than 900 airport lounges around the world.

- Hotels.com: Standard Chartered Shukran World Credit Card offers attractive 10 percent off on bookings done using this credit card at Hotels.com.

- Cinema Offers: Standard Chartered Shukran World Credit Card offers 4 complimentary movie tickets on weekdays and 10 complimentary tickets on Sundays at VOX Cinemas.

- Careem Rides: Standard Chartered Shukran World Credit Card offers a 20 percent discount on rides booked with Careem in the UAE.

- Travel Inconvenience Protection: Standard Chartered Shukran World Credit Card offers travel inconvenience protection against any inconvenience caused to the cardmembers due to baggage delays, flight delays, flight cancellations, and more.

- Travel Insurance: Standard Chartered Shukran World Credit Card offers travel insurance benefits against any loss, damage or bodily injury caused to the cardmembers while traveling. The cardmembers can also get the travel insurance confirmation letter from the insurer.

How to Redeem Reward Points for Points-to-Miles Services?

With Standard Chartered Reward Points Credit Cards, the cardmembers get AED 1 for 100 earned reward points. Here are a few simple steps to help cardmembers convert their reward points into Emirates Skywards Miles.

- Log in to the mobile banking portal of Standard Chartered Bank and click on the 360 Rewards icon.

- Go to the Main Menu and click on Purchase with Rewards.

- On the next window, click on transfer rewards and choose Emirates Skywards Miles to convert reward points into miles.

- Specify the number of reward points you need to redeem as miles.

Eligibility Criteria to Apply for Standard Chartered Reward Points Credit Cards

Here are the eligibility criteria the applicants need to meet when applying for Standard Chartered Reward Points Credit Cards.

|

Standard Chartered Rewards Credit Cards |

Eligibility Criteria |

|---|---|

|

Standard Chartered Visa Infinite Credit Card |

|

|

Standard Chartered Manhattan Rewards+ Credit Card |

|

|

Standard Chartered Saadiq Platinum Ujrah Credit Card |

|

|

Standard Chartered Shukran World Credit Card |

|

Documents Required to Apply for Standard Chartered Reward Points Credit Cards

Here are the documents required to apply for Standard Chartered Reward Points Credit Cards.

|

Standard Chartered Rewards Credit Cards |

Documents Required |

|---|---|

|

Standard Chartered Visa Infinite Credit Card |

|

|

Standard Chartered Manhattan Rewards+ Credit Card |

|

|

Standard Chartered Saadiq Platinum Ujrah Credit Card |

|

|

Standard Chartered Shukran World Credit Card |

|

How to Apply for Standard Chartered Reward Points Credit Cards?

Here are a few simple ways to apply for a Standard Chartered Reward Points Credit Card.

- Online Banking - Standard Chartered Bank offers an online banking portal to help its customers access their banking details online in just a few clicks. The applicants can simply log in to their online banking account and go to the requests section to apply for their preferred Standard Chartered Reward Points Credit Card. The applicants need to fill in the online application form on the portal and submit the same with all the essential documents.

- Mobile Banking - The existing Standard Chartered Bank customers can also download the bank’s mobile banking app and register on the same to apply for their desired Reward Points, Credit Card. The applicants need to go to the requests section on the mobile app and provide their details with all the supporting documents to complete the application process.

- Bank’s Website - The applicants who do not have access to the mobile banking app or the bank’s online banking portal can apply for their chosen Reward Points Credit Card on the bank’s website. All they need to do is fill out the application form and upload all the required documents while submitting the same.

- Bank’s Branch - The applicants with no access to the Internet can visit one of the Standard Chartered Bank’s branches to apply for their preferred reward points credit card. These applicants need to carry all their documents with them and submit the same with a filled out application form in the presence of a bank representative. This helps them avoid making any mistakes in filling the application form.

- Our Website - This is one of the most convenient ways of applying for a credit card online. The applicants can simply go to the credit cards section on our website, enter their details in the application form and submit the same with required documents. They can also call our helpdesk in case of any doubt. Our financial experts analyse the customers’ financial needs and help them know the features and benefits of a suitable credit card.

Fees & Charges of Standard Chartered Reward Points Credit Cards

Here are the fees and charges applicable on Standard Chartered Reward Points Credit Cards.

|

Types of Standard Chartered Reward Points Credit Cards |

Fees and Charges |

Amount |

|---|---|---|

|

Standard Chartered Visa Infinite Credit Card |

Annual Fee on Primary Card |

AED 1575 |

|

Annual Fee on Supplementary Cards |

First two cards: Free 3rd card onwards: AED 525 |

|

|

Finance Charges for Retail Transactions |

3.25 percent |

|

|

Finance Charges for Cash Transactions |

3.25 percent |

|

|

Over-limit Fees |

AED 292.95 |

|

|

Late Payment Fees |

AED 241.50 |

|

|

Standard Chartered Manhattan Rewards+ Credit Card |

Annual Fee on Primary Card |

AED 525 |

|

Annual Fee on Supplementary Cards |

First two cards: Free 3rd card onwards: AED 157 |

|

|

Finance Charges for Retail Transactions |

3.33 percent |

|

|

Finance Charges for Cash Transactions |

3.09 percent |

|

|

Over-limit Fees |

AED 292.95 |

|

|

Late Payment Fees |

AED 241.50 |

|

|

Standard Chartered Saadiq Platinum Ujrah Credit Card |

Annual Fee on Primary Card |

AED 315 |

|

Annual Fee on Supplementary Cards |

First four cards: Free Fifth card onwards: AED 157.50 |

|

|

Cash Advance Charge |

AED 131.25 |

|

|

Over-limit Fees |

AED 292.95 |

|

|

Late Payment Fees |

AED 241.50 |

|

|

Maintenance Fees per month |

AED 800 |

|

|

Card Replacement Charge |

AED 78.75 |

|

|

Duplicate Statement (more than three months) |

AED 47.25 |

|

|

Returned Cheque |

AED 105 |

|

|

Processing Outstation Cheque |

AED 52.50 |

|

|

Sales Voucher Copy (maximum three months) |

Hotel - AED 68.25 Airline - AED 68.25 Retail - AED 52.50 |

|

|

Account Charges Statement per month (per account per statement) |

AED 10.50 |

|

|

Foreign Transaction Fee |

2.99 percent of the amount of transaction |

|

|

Standard Chartered Shukran World Credit Card |

Annual Fee on Primary Card |

AED 262.50 |

|

Annual Fee on Supplementary Cards |

First two cards: Free Third card onwards: AED 105 |

|

|

Finance Charges for Retail Transactions |

2.99 percent |

|

|

Finance Charges for Cash Transactions |

2.99 percent |

|

|

Over-limit Fees |

AED 236.25 |

|

|

Late Payment Fees |

AED 241.50 |

Other Bank's Rewards Credit Card in UAE

More From Credit Cards

- Recent Articles

- Popular Articles